Visa Direct Transactions Growth

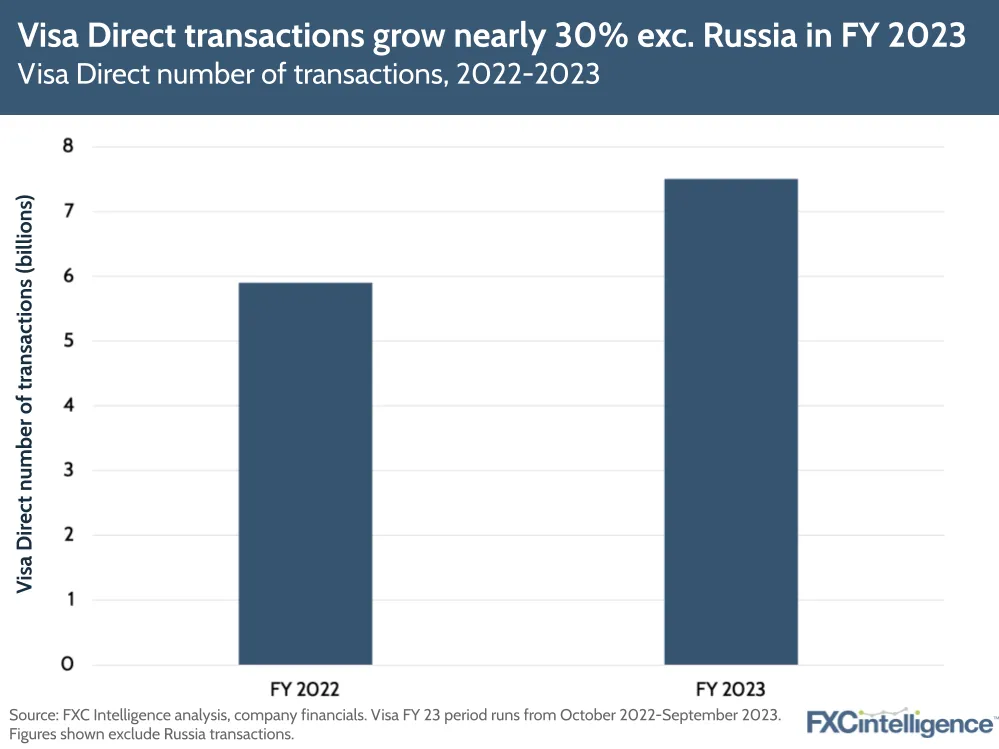

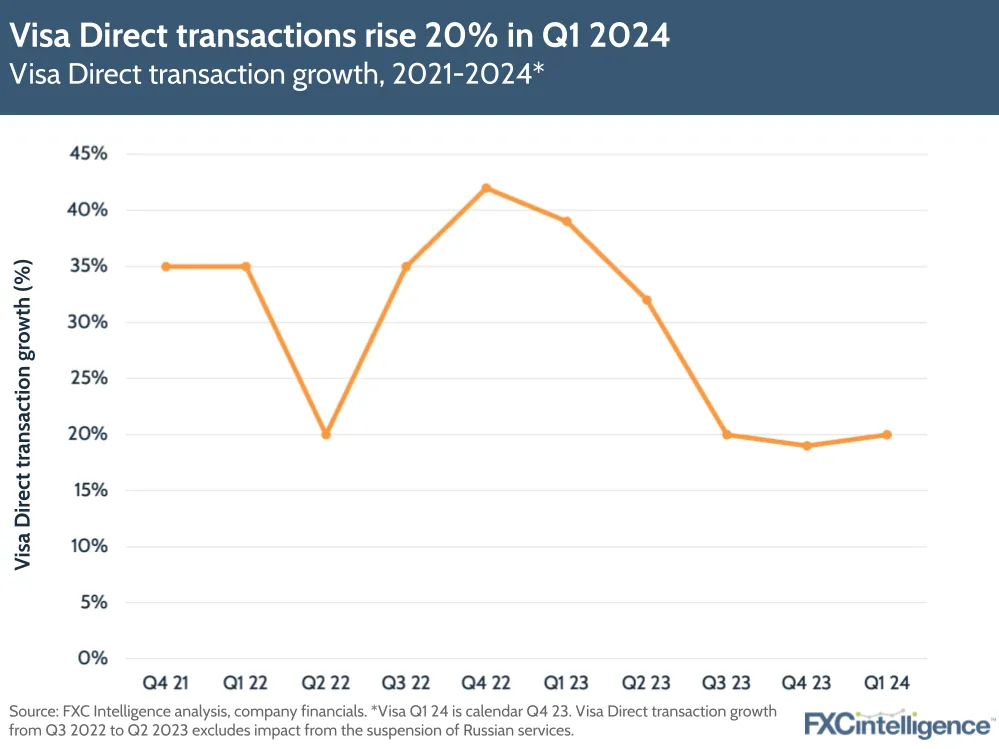

Visa Direct Transactions Growth - Commercial volumes were up 5%. For example, visa direct expanded its. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. This growth came from new partnerships and growing existing relationships. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion.

New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. For example, visa direct expanded its. Commercial volumes were up 5%. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. This growth came from new partnerships and growing existing relationships.

For example, visa direct expanded its. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. Commercial volumes were up 5%. This growth came from new partnerships and growing existing relationships.

Visa and Mastercard boost partnerships, volumes in Q3 23

Commercial volumes were up 5%. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. This growth came from new partnerships and growing existing relationships. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. For.

Visa and Mastercard crossborder volumes drive growth in Q4 23

For example, visa direct expanded its. Commercial volumes were up 5%. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. This growth came from new partnerships and growing existing relationships. New flows revenues were up 22%, and visa direct transactions grew by 38% in the.

Exclusive Report How Digital Payments Fared in 2020 Razorpay Payment

This growth came from new partnerships and growing existing relationships. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. Commercial volumes were up 5%. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. New.

Visa Stock's Growth Journey Continues (NYSEV) Seeking Alpha

This growth came from new partnerships and growing existing relationships. For example, visa direct expanded its. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. There were 14 billion.

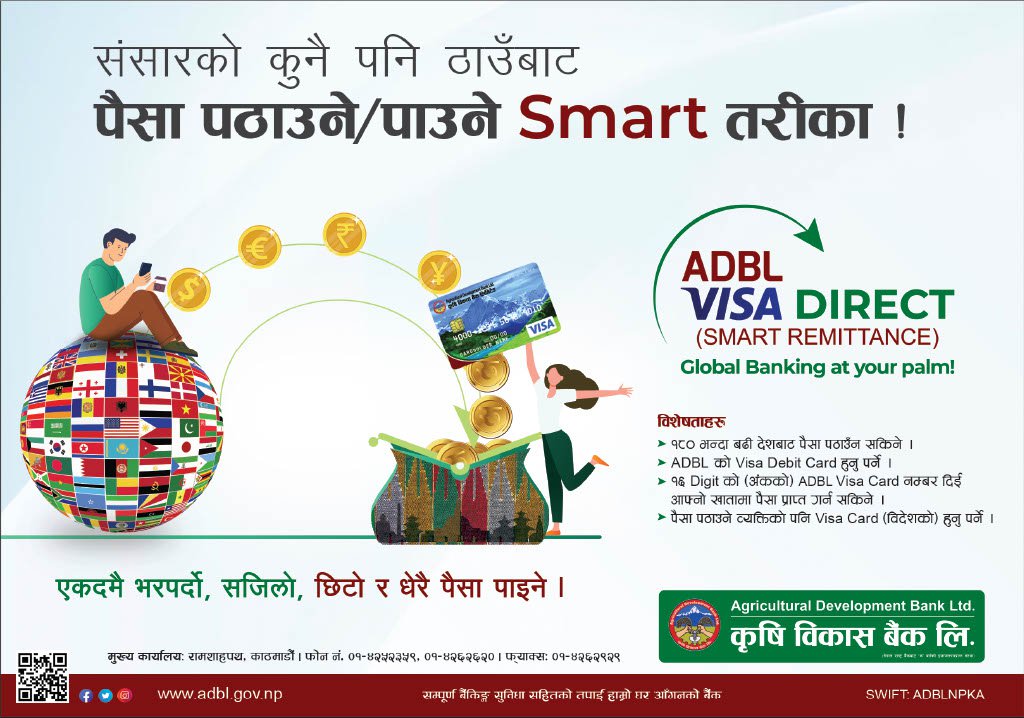

Visa Direct Service ADBL

For example, visa direct expanded its. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. This growth came from new partnerships and growing existing relationships..

Visa Direct Transactions Surge 36

For example, visa direct expanded its. This growth came from new partnerships and growing existing relationships. Commercial volumes were up 5%. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct.

Visa A Value Play In A FastGrowing Industry (NYSEV) Seeking Alpha

There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by. Commercial volumes were up 5%. This growth came from new partnerships and growing existing relationships. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. For.

Visa Payment Options Push Payments and Visa Direct YouTube

Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. This growth came from new partnerships and growing existing relationships. For example, visa direct expanded its. There were 14 billion.

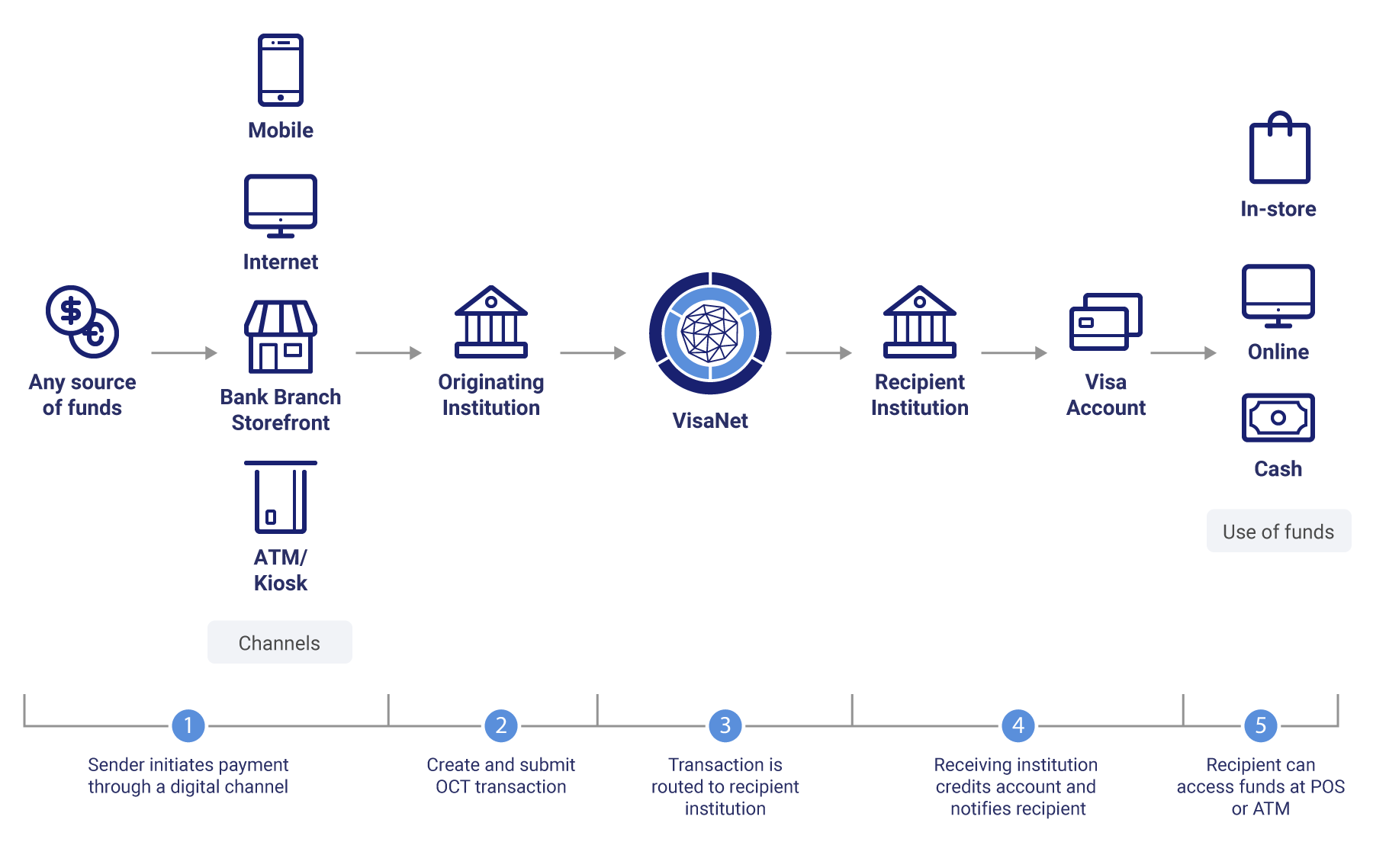

Visa Direct Account and Wallet Overview

For example, visa direct expanded its. Commercial volumes were up 5%. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. This growth came from new partnerships and growing existing relationships. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization,.

Getting Started with Visa Direct

Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. For example, visa direct expanded its. Commercial volumes were up 5%. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. There were 14 billion tokenized transactions in the fourth.

This Growth Came From New Partnerships And Growing Existing Relationships.

For example, visa direct expanded its. Visa inc (v) reports a 12% increase in net revenue and significant growth in new flows and visa direct transactions. New flows revenues were up 22%, and visa direct transactions grew by 38% in the latest quarter to 2.8 billion. There were 14 billion tokenized transactions in the fourth quarter, a growth rate surpassing 60% — and with tokenization, approval rates have grown by.

.png)