Tax Rebate Calendar

Tax Rebate Calendar - You will need the total amount of your third economic impact payment. If your income is $73,000 or less, you can file your. Our tax refund chart lists the federal tax refund dates for direct deposits and mailed checks. Web the 2024 tax refund schedule for the 2023 tax year starts on january 29th. Web the property tax rebate is a rebate of up to $675 of property taxes paid on a principal montana residence. You can claim the credit for improvements. Web getting back to this year's special state payments, the eligibility criteria, payment amounts, and delivery timelines differ from state to state. If you're eligible you must file a 2020 tax return to claim the 2020 recovery rebate credit, even if you usually don’t file a tax return. If you did not receive the full amount of eip3 before december 31, 2021, claim the 2021 recovery rebate credit (rrc) on your 2021 form. Web i will explain:

Web 2024 tax deadline: Every uk resident under the age of 75 can add money to a pension and get tax relief. The application period opens august 15 and closes october 1. But if you’re eager to receive. Web in fall 2022, taxpayers received $750 refunds via direct checks; The irs does not release a calendar, but continues to issue guidance that most filers should receive their refund. Find out how to boost your retirement savings. 1, 2023, you may qualify for a tax credit up to $3,200. The quarterly caip payments are paid on the 15th of january, april, july, and october. Web i will explain:

1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements. Web 2021 recovery rebate credit. Web the 2024 tax season officially started monday, january 29, and this year, as usual, you have until april 15 to file your tax return. If you’re entitled to receive the ccr, you can expect to receive your payments on the 15th of april, july, october and january. Web this tax guide looks at income tax rebates and discusses the process involved and considerations for completing a tax rebat claim. Find out how to boost your retirement savings. Web getting back to this year's special state payments, the eligibility criteria, payment amounts, and delivery timelines differ from state to state. Web check how to claim a tax refund. Web your 2021 recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund.

Irs Tax Calendar 2024 2024 Calendar Printable

We get the equivalent rebate. Use this tool to find out what you need to do if you paid too much on:. If you're eligible you must file a 2020 tax return to claim the 2020 recovery rebate credit, even if you usually don’t file a tax return. You can claim the credit for improvements. The irs does not release.

Irs Tax Calendar 2024 Lila Shelba

You can claim the credit for improvements. Web the 2024 tax season officially started monday, january 29, and this year, as usual, you have until april 15 to file your tax return. Find out how to boost your retirement savings. Web the deadlines to file a return and claim the 2020 and 2021 credits are may 17, 2024, and april.

Delaware Tax Rebate 2023 Printable Rebate Form

Web the 2024 tax season officially started monday, january 29, and this year, as usual, you have until april 15 to file your tax return. Web your 2021 recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund. Web this tax guide looks at income tax rebates and discusses the process involved.

Managing Your Tax Rebate Luxe Calendar

Every uk resident under the age of 75 can add money to a pension and get tax relief. Web your 2021 recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund. If your income is $73,000 or less, you can file your. Web 2021 recovery rebate credit. Web your 2021 recovery rebate.

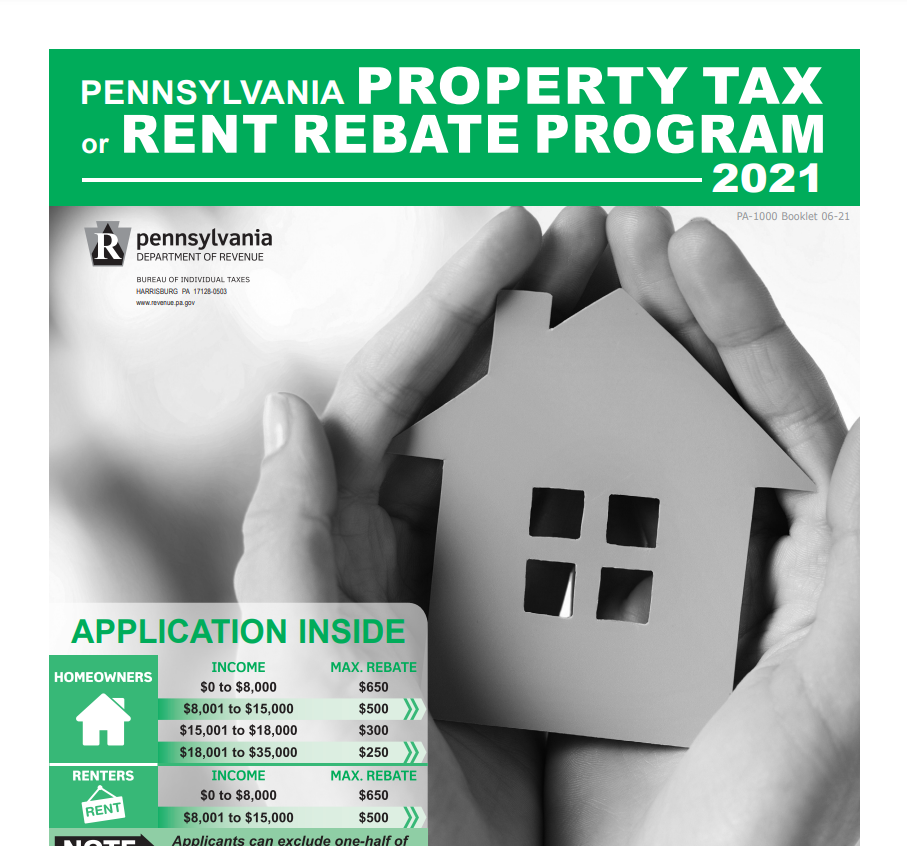

Property Tax Rent Rebate Pa 2024 Calendar Nonna Deborah

We pay for carbon pricing. If you’re entitled to receive the ccr, you can expect to receive your payments on the 15th of april, july, october and january. Find out how to boost your retirement savings. Web getting back to this year's special state payments, the eligibility criteria, payment amounts, and delivery timelines differ from state to state. Web your.

Where’s My Refund? The IRS Refund Schedule 2022 Check City

Web your 2021 recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund. If you’re entitled to receive the ccr, you can expect to receive your payments on the 15th of april, july, october and january. If your income is $73,000 or less, you can file your. Find out how to boost.

What To Expect With your Tax Rebate Mass.gov

You may be able to get a tax refund (rebate) if you’ve paid too much tax. Web 2024 tax deadline: Our tax refund chart lists the federal tax refund dates for direct deposits and mailed checks. Every uk resident under the age of 75 can add money to a pension and get tax relief. Web 2021 recovery rebate credit.

Tax Return Dates 2023 Chart at Donna Lockhart blog

Web the 2024 tax season officially started monday, january 29, and this year, as usual, you have until april 15 to file your tax return. If you're eligible you must file a 2020 tax return to claim the 2020 recovery rebate credit, even if you usually don’t file a tax return. You may be able to get a tax refund.

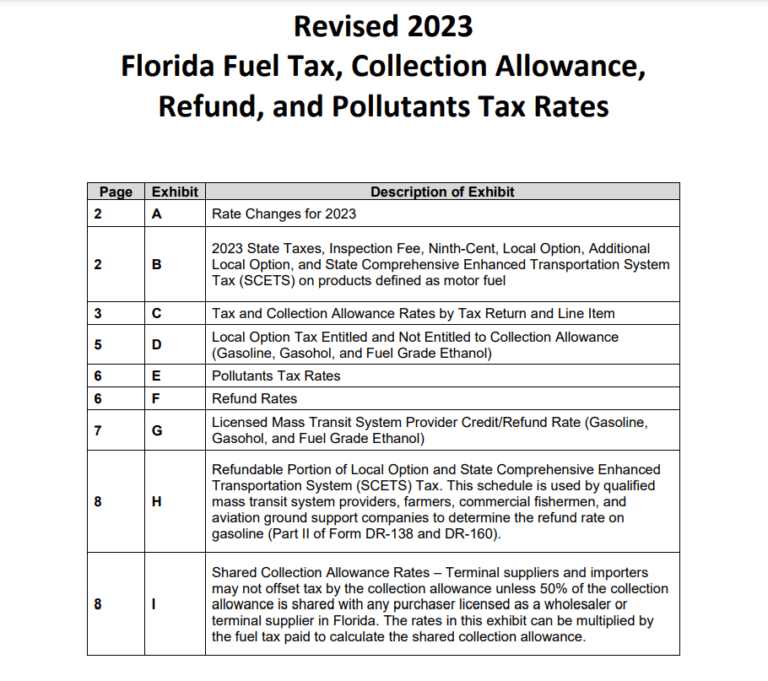

Florida Tax Rebate 2023 Get Tax Relief and Boost Economic Growth

You will need the total amount of your third economic impact payment. Web the 2024 tax refund schedule for the 2023 tax year starts on january 29th. Web tax row accountancy firm client wins hmrc court case. Tool on irs.gov is the most convenient way to. Jason new foothills county, alta.

Tax Rebate 2024 Australia Marja Nichol

The application period opens august 15 and closes october 1. The quarterly caip payments are paid on the 15th of january, april, july, and october. If your income is $73,000 or less, you can file your. Web the deadlines to file a return and claim the 2020 and 2021 credits are may 17, 2024, and april 15, 2025, respectively. 27,.

Every Uk Resident Under The Age Of 75 Can Add Money To A Pension And Get Tax Relief.

You can claim the credit for improvements. 1, 2023, you may qualify for a tax credit up to $3,200. We pay for carbon pricing. Web the 2024 tax season officially started monday, january 29, and this year, as usual, you have until april 15 to file your tax return.

The Quarterly Caip Payments Are Paid On The 15Th Of January, April, July, And October.

Web when to expect your payments. Web pension tax relief explained. A man ordered to repay thousands of pounds after being caught up in a tax rebate scheme has won his case against hm. Web the property tax rebate is a rebate of up to $675 of property taxes paid on a principal montana residence.

Web This Tax Guide Looks At Income Tax Rebates And Discusses The Process Involved And Considerations For Completing A Tax Rebat Claim.

Web in fall 2022, taxpayers received $750 refunds via direct checks; Web the american rescue plan act of 2021, enacted march 11, 2021, provides a 2021 recovery rebate credit (rrc) which can be claimed on 2021 individual income. Web your 2021 recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund. Web your 2021 recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund.

Tool On Irs.gov Is The Most Convenient Way To.

Web the deadlines to file a return and claim the 2020 and 2021 credits are may 17, 2024, and april 15, 2025, respectively. If you did not receive the full amount of eip3 before december 31, 2021, claim the 2021 recovery rebate credit (rrc) on your 2021 form. But if you’re eager to receive. Web getting back to this year's special state payments, the eligibility criteria, payment amounts, and delivery timelines differ from state to state.