Spx Options Calendar Spread

Spx Options Calendar Spread - Web s&p 500 index options capture u.s. Stock market exposure with ease utilizing spx suite of options with a variety of contract sizes, settlements, and expirations. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with. The maximum profit in this strategy is the difference between the strike prices. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. Web the benefits of index options let you trade right up to market close on expiration day. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. It's not the biggest quarterly expiration on record, but it's still pretty large. Investors will see option contracts tied to more. Say you have a portfulio of several.

Web use the options expiration calendar, on marketwatch, to view options expiration. Theta is the changes to options value with. Web options market expectations from the fomc. Web a calendar spread, also known as a time spread, involves simultaneously buying and selling two options with the same strike price but different expiration dates. Web s&p 500 index options capture u.s. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. Still determining things like strikes and the dte for the. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. We seemingly have been discussing the potential outcomes for this afternoon’s. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with.

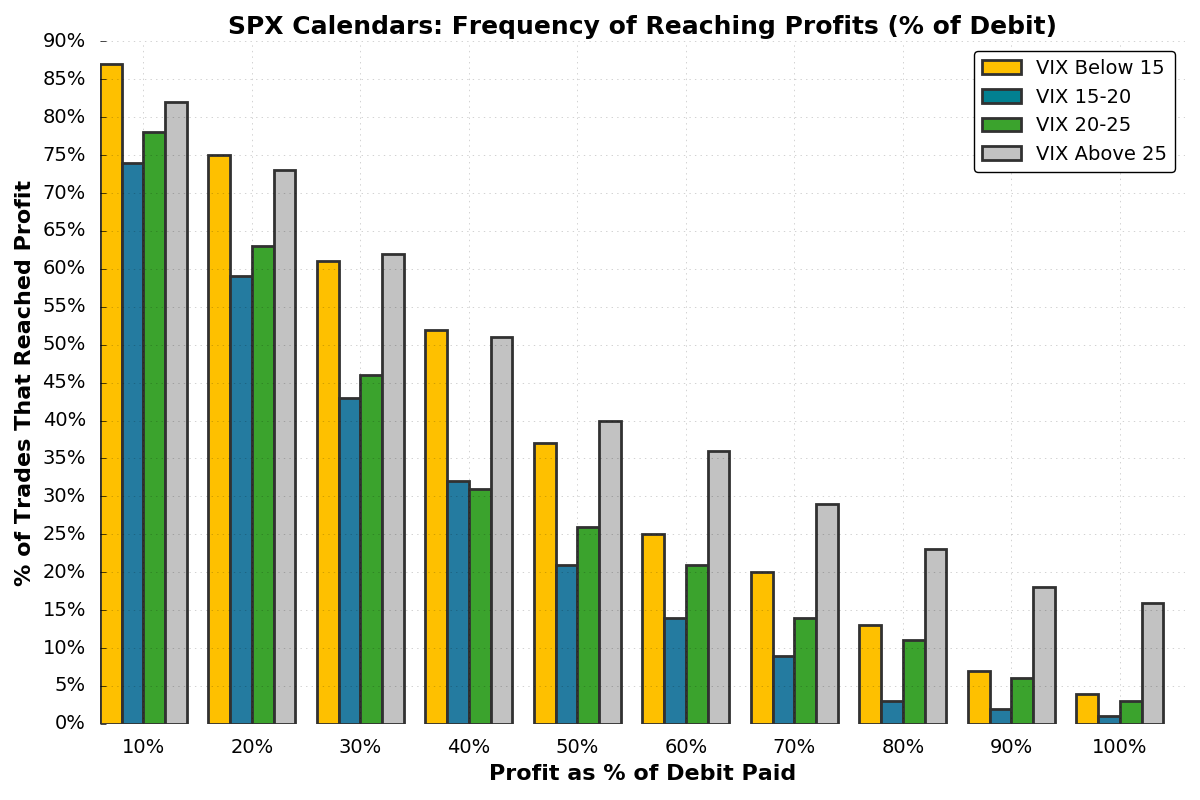

In this post we will focus on. Web it is a double calendar.paired with an iron condor. We all would like all our trades to be winners, but we know this. Theta is the changes to options value with. Still determining things like strikes and the dte for the. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. Stock market exposure with ease utilizing spx suite of options with a variety of contract sizes, settlements, and expirations. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. Web use the options expiration calendar, on marketwatch, to view options expiration.

How Calendar Spreads Work (Best Explanation) projectoption

Say you have a portfulio of several. We seemingly have been discussing the potential outcomes for this afternoon’s. Web options market expectations from the fomc. Web s&p 500 index options capture u.s. Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage.

SPX Calendar Spread How I Made a 540 Profit with Options Trading

Investors will see option contracts tied to more. Web s&p 500 index options capture u.s. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. In this post we will focus on. Web a bull call spread is used when a moderate rise in.

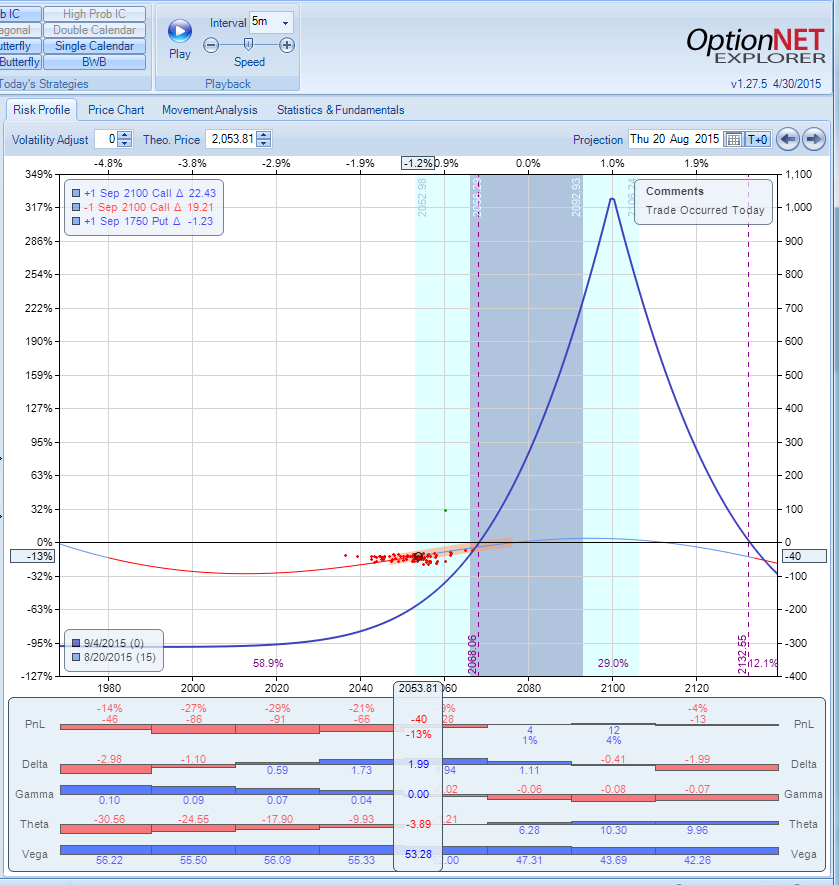

SPX Calendar Spread Calendar Spread Profit and Loss

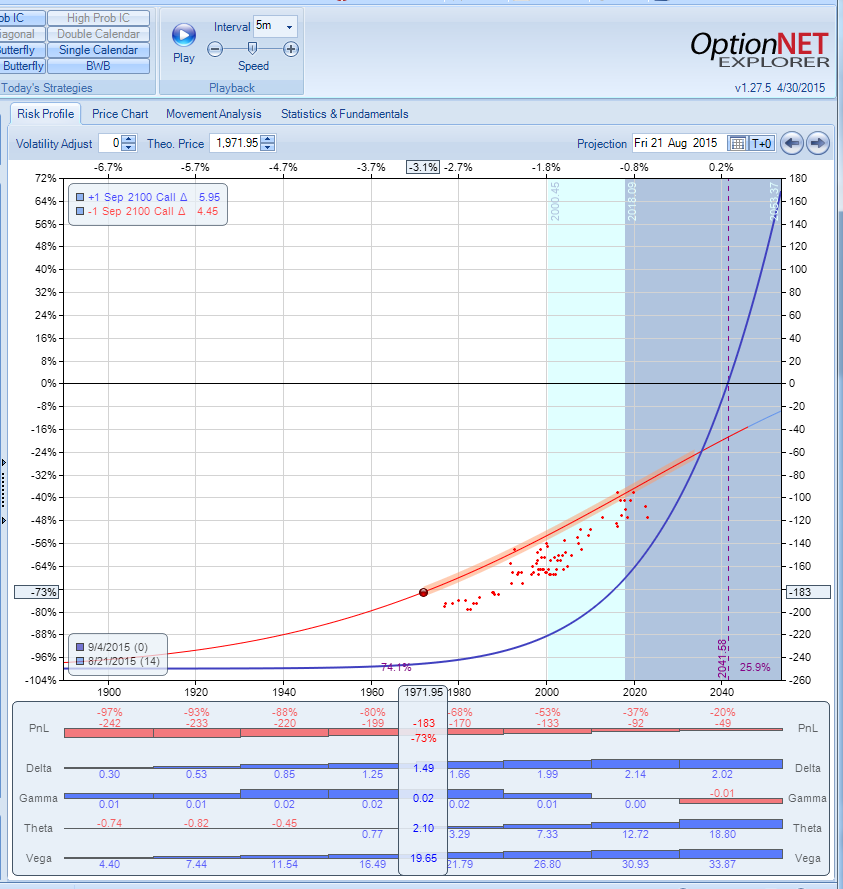

Stock market exposure with ease utilizing spx suite of options with a variety of contract sizes, settlements, and expirations. We all would like all our trades to be winners, but we know this. In this post we will focus on. We seemingly have been discussing the potential outcomes for this afternoon’s. Web a calendar spread is what we call the.

How to Trade SPX Options SPX Calendar Spread Example

Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage. We all would like all our trades to be winners, but we know this. Web a calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different expirations..

Calendar Call Option Spread [SPX] YouTube

Web a calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different expirations. In this post we will focus on. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. Stock market exposure with ease utilizing spx.

How to Trade SPX Options with a Small Account (Part 2) YouTube

Web use the options expiration calendar, on marketwatch, to view options expiration. We seemingly have been discussing the potential outcomes for this afternoon’s. It's not the biggest quarterly expiration on record, but it's still pretty large. Web 158 rows view the basic ^spx option chain and compare options of s&p 500 index on yahoo finance. Investors will see option contracts.

Combining Calendar Spreads with Butterfly Spreads SPX Options YouTube

Web use the options expiration calendar, on marketwatch, to view options expiration. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. Web it is a double calendar.paired with an iron condor. In this post we will focus on. Web the benefits of index options let you trade right up.

Double Calendar Spread in SPX YouTube

Investors will see option contracts tied to more. Web options market expectations from the fomc. Say you have a portfulio of several. Web use the options expiration calendar, on marketwatch, to view options expiration. Web s&p 500 index options capture u.s.

How to Trade SPX Options SPX Calendar Spread Example

The maximum profit in this strategy is the difference between the strike prices. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. We all would like all our trades to be winners, but we know this. Web a calendar spread is a strategy involving buying longer term options and selling.

SPX 15 Day Calendar Spread Calm Hedge

Web a calendar spread is what we call the options trade structure where you are buying and selling the same strike option across 2 different expirations. Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage. Web 1.) buying puts or calls. Web a calendar spread, also known as a.

Web By Joseph Adinolfi.

Web use the options expiration calendar, on marketwatch, to view options expiration. Web a bull call spread is used when a moderate rise in the price of the underlying asset is expected. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with. We seemingly have been discussing the potential outcomes for this afternoon’s.

It's Not The Biggest Quarterly Expiration On Record, But It's Still Pretty Large.

Web 1.) buying puts or calls. Web s&p 500 index options capture u.s. In this post we will focus on. Say you have a portfulio of several.

Investors Will See Option Contracts Tied To More.

Web the benefits of index options let you trade right up to market close on expiration day. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with. Calendars tend to be long vega and that can be augmented (or buffered) with a short vega iron condor. Web 158 rows view the basic ^spx option chain and compare options of s&p 500 index on yahoo finance.

Web A Calendar Spread Is What We Call The Options Trade Structure Where You Are Buying And Selling The Same Strike Option Across 2 Different Expirations.

Web a calendar spread uses the different option expiration dates to create a difference in theta to increase our leverage. Web a calendar spread, also known as a time spread, involves simultaneously buying and selling two options with the same strike price but different expiration dates. Theta is the changes to options value with. We all would like all our trades to be winners, but we know this.

![Calendar Call Option Spread [SPX] YouTube](https://i.ytimg.com/vi/em03gM2jnxs/maxresdefault.jpg)