Debt Repayment Calendar

Debt Repayment Calendar - It also determines out how much of your repayments. Web in this section, you can set your aim for debt repayment: Web the calculator below estimates the amount of time required to pay back one or more debts. Web this debt repayment calculator figures how much faster you will get out of debt and how how much interest you will save by adding an additional principal repayment to your next. Your results will give all the relevant. Give each entry a name, such as the loan company or credit cards. Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. Web download printable debt payoff charts and trackers for excel and pdf. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and. For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance.

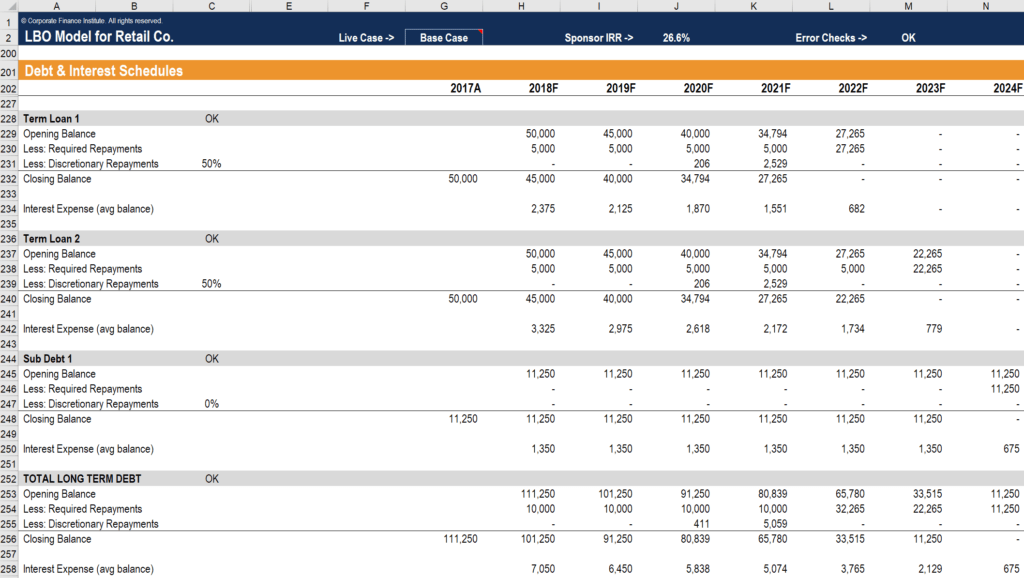

For free & impartial money advice. It can be utilized for. Web in this section, you can set your aim for debt repayment: Web after you have entered your debt details and an extra payment amount, press the “calculate payoff” button to generate your results. Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal amortization and interest expense. Get your debt snowball rolling and that. Cnbc select offers advice on how to make 2024 the year you confidently manage your debt. Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. Web according to irs guidelines, initial startup costs must be amortized. You can even create a.

Cnbc select offers advice on how to make 2024 the year you confidently manage your debt. Web download printable debt payoff charts and trackers for excel and pdf. Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal amortization and interest expense. Web in this section, you can set your aim for debt repayment: For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance. It also determines out how much of your repayments. Do you expect any additional income that you can apply to your payments?. Pay the minimum amount monthly; Give each entry a name, such as the loan company or credit cards. Get your debt snowball rolling and that.

Free Printable Debt Payoff Planner Printable Word Searches

Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal amortization and interest expense. Web in this section, you can set your aim for debt repayment: How to use this calculator. Web the repayment calculator can be used to find the repayment amount or length of debts, such as credit cards, mortgages, auto loans, and personal loans..

Sample Debt Repayment Schedule Debt Interest

Your results will give all the relevant. Web the repayment calculator can be used to find the repayment amount or length of debts, such as credit cards, mortgages, auto loans, and personal loans. Pay the minimum amount monthly; It can be utilized for. Web simply fill out the form with all your debts, enter a monthly dollar amount you can.

Debt Repayment Printables Simply Stacie

Get your debt snowball rolling and that. Web download printable debt payoff charts and trackers for excel and pdf. It can be utilized for. Web after you have entered your debt details and an extra payment amount, press the “calculate payoff” button to generate your results. Web simply fill out the form with all your debts, enter a monthly dollar.

Debt Schedule Timing of Repayment, Interest, and Debt Balances

Web the calculator below estimates the amount of time required to pay back one or more debts. Web download printable debt payoff charts and trackers for excel and pdf. Cnbc select offers advice on how to make 2024 the year you confidently manage your debt. You can even create a. Web after you have entered your debt details and an.

How to Make a Debt Repayment Calendar to countdown your debt repayment

Get your debt snowball rolling and that. It also determines out how much of your repayments. It can be utilized for. Web in this section, you can set your aim for debt repayment: Cnbc select offers advice on how to make 2024 the year you confidently manage your debt.

Debt Repayment Printables Simply Stacie

It also determines out how much of your repayments. For free & impartial money advice. You can even create a. Wall street is already trying to handicap how long the us government has until it exhausts its borrowing authority once the debt ceiling returns in early 2025,. Web the repayment calculator can be used to find the repayment amount or.

Debt Tracker Debt Snowball Spreadsheet Debt Repayment Etsy Australia

This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and. Web the calculator below estimates the amount of time required to pay back one or more debts. Web in this section, you can set your aim for debt repayment: Web download printable debt payoff charts and trackers for excel and pdf. How to use this.

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Web as a debt is repaid, the debts are eliminated in ascending size. For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance. Cnbc select offers advice on how to make 2024 the year you confidently manage your debt. Web download printable debt payoff charts and.

The Ultimate Debt Payoff Planner That Will Help You Crush Your Debt

Track your debt payoff goals. Web according to irs guidelines, initial startup costs must be amortized. Web as a debt is repaid, the debts are eliminated in ascending size. Get your debt snowball rolling and that. Pay the minimum amount monthly;

23+ Debt repayment calendar HuzaifaAdley

Cnbc select offers advice on how to make 2024 the year you confidently manage your debt. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and. Do you expect any additional income that you can apply to your payments?. For this step, you’ll need to input the basic information you collected about your existing debt.

Web Simply Fill Out The Form With All Your Debts, Enter A Monthly Dollar Amount You Can Add To Your Payoff Plan, And Click The “Calculate Debt Snowball” Button.

Do you expect any additional income that you can apply to your payments?. Get your debt snowball rolling and that. Web the calculator below estimates the amount of time required to pay back one or more debts. For this step, you’ll need to input the basic information you collected about your existing debt into the debt calculator, including the current balance.

Give Each Entry A Name, Such As The Loan Company Or Credit Cards.

Web as a debt is repaid, the debts are eliminated in ascending size. Web the repayment calculator can be used to find the repayment amount or length of debts, such as credit cards, mortgages, auto loans, and personal loans. Web in this section, you can set your aim for debt repayment: Web after you have entered your debt details and an extra payment amount, press the “calculate payoff” button to generate your results.

It Also Determines Out How Much Of Your Repayments.

Web this debt repayment calculator figures how much faster you will get out of debt and how how much interest you will save by adding an additional principal repayment to your next. It can be utilized for. Pay the minimum amount monthly; This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and.

Track Your Debt Payoff Goals.

How many debts do you want to include in your plan? Web according to irs guidelines, initial startup costs must be amortized. Web debt schedule tracks the outstanding debt balances and payment obligations, namely principal amortization and interest expense. For free & impartial money advice.

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball.jpg)