Common Sized Balance Sheet

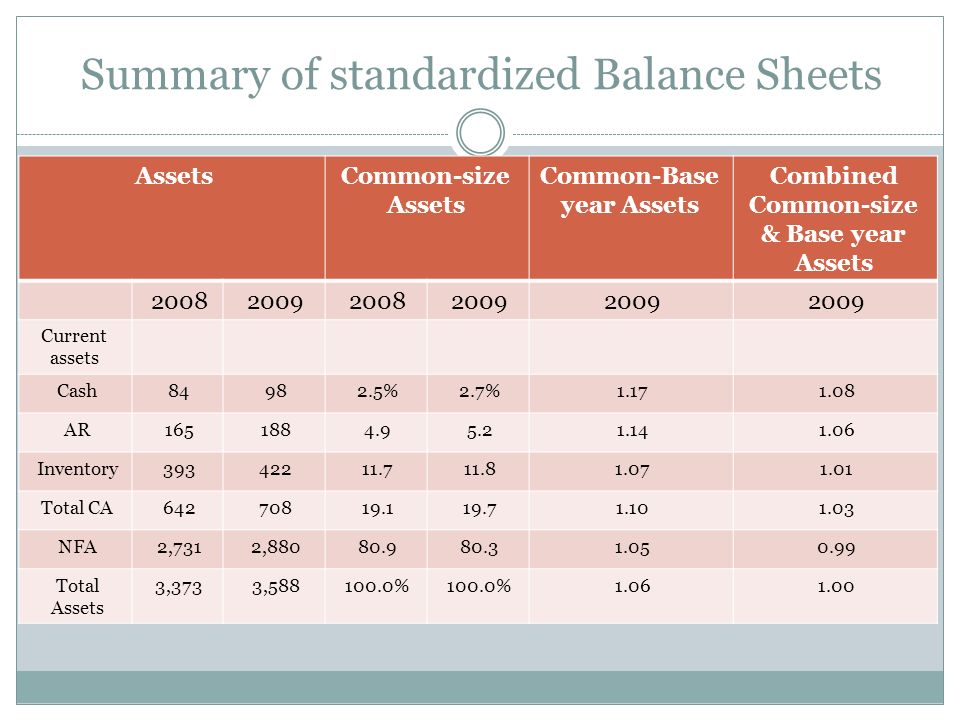

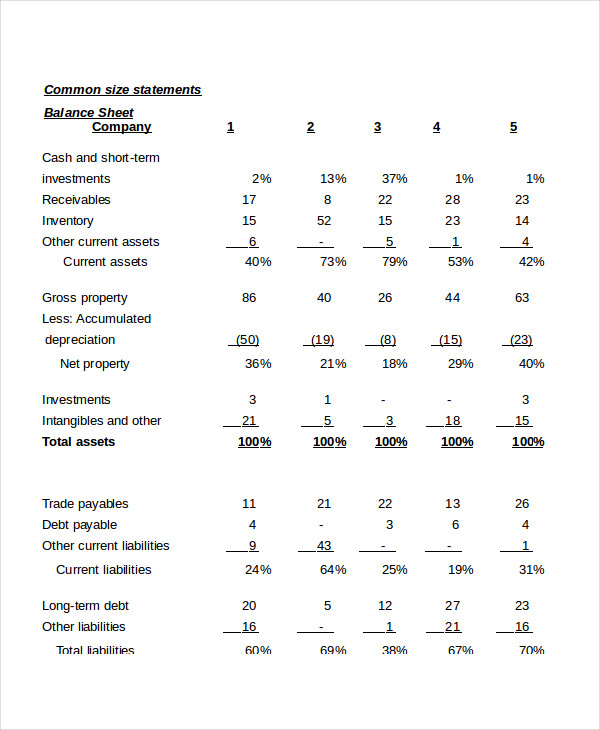

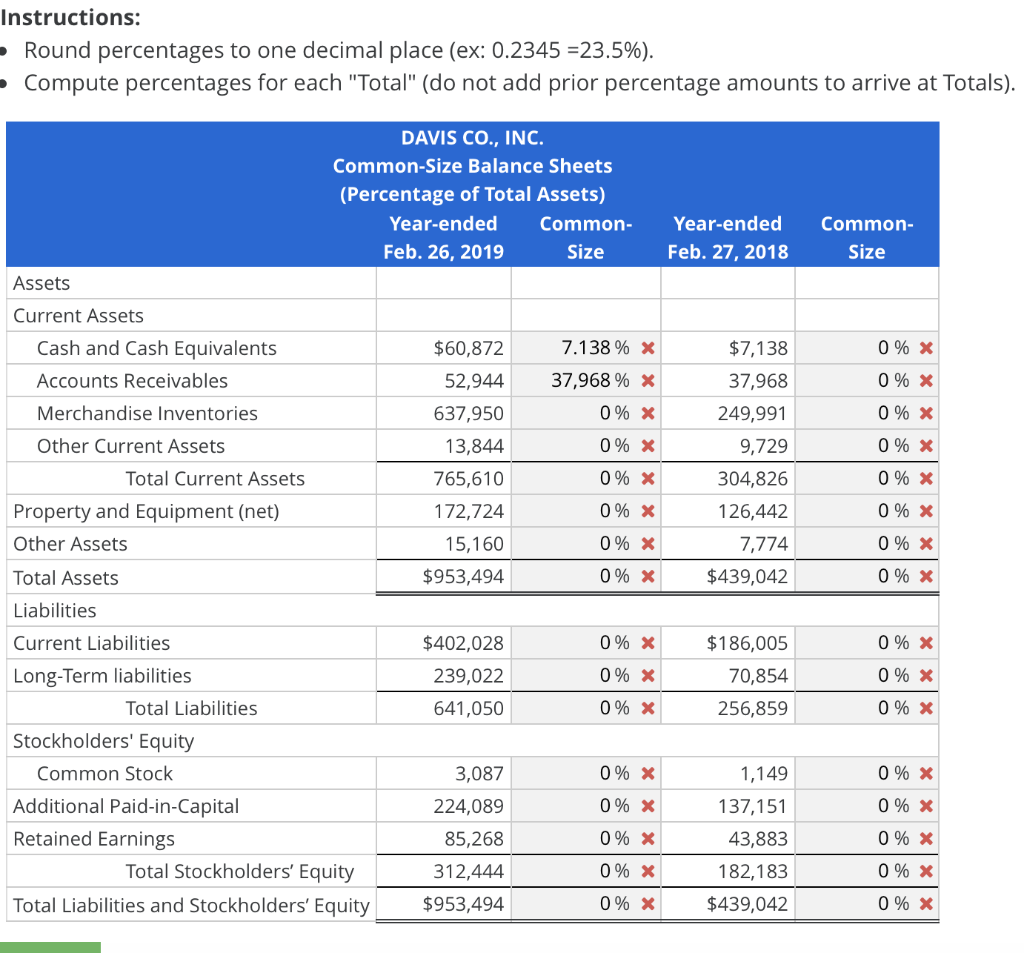

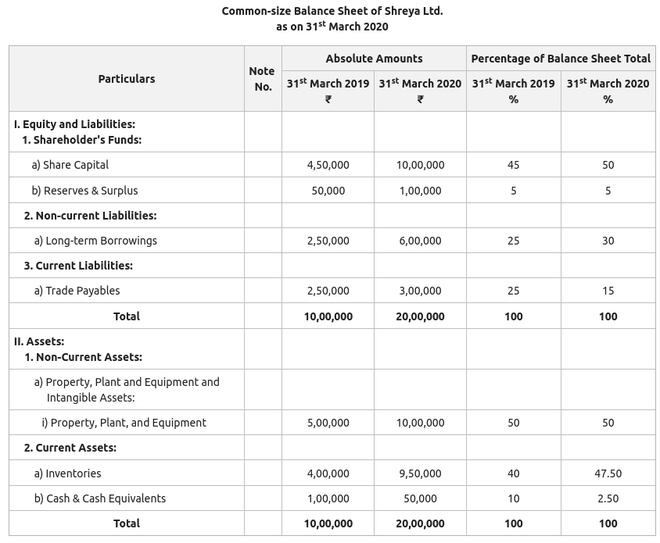

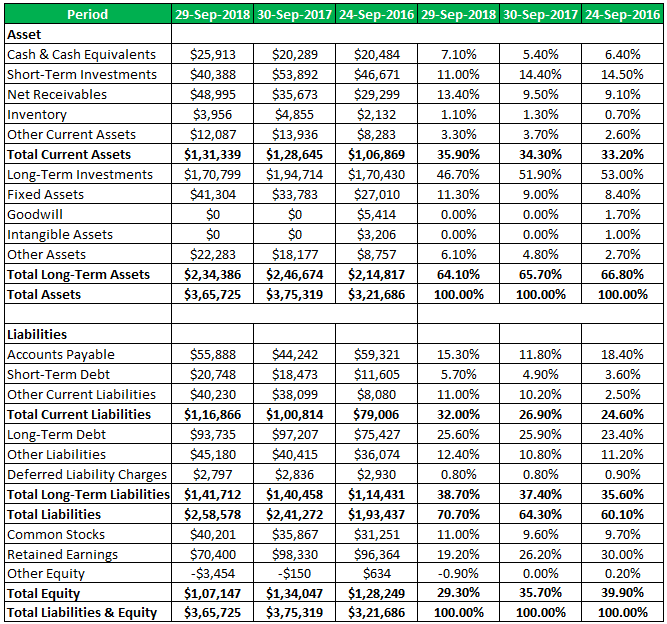

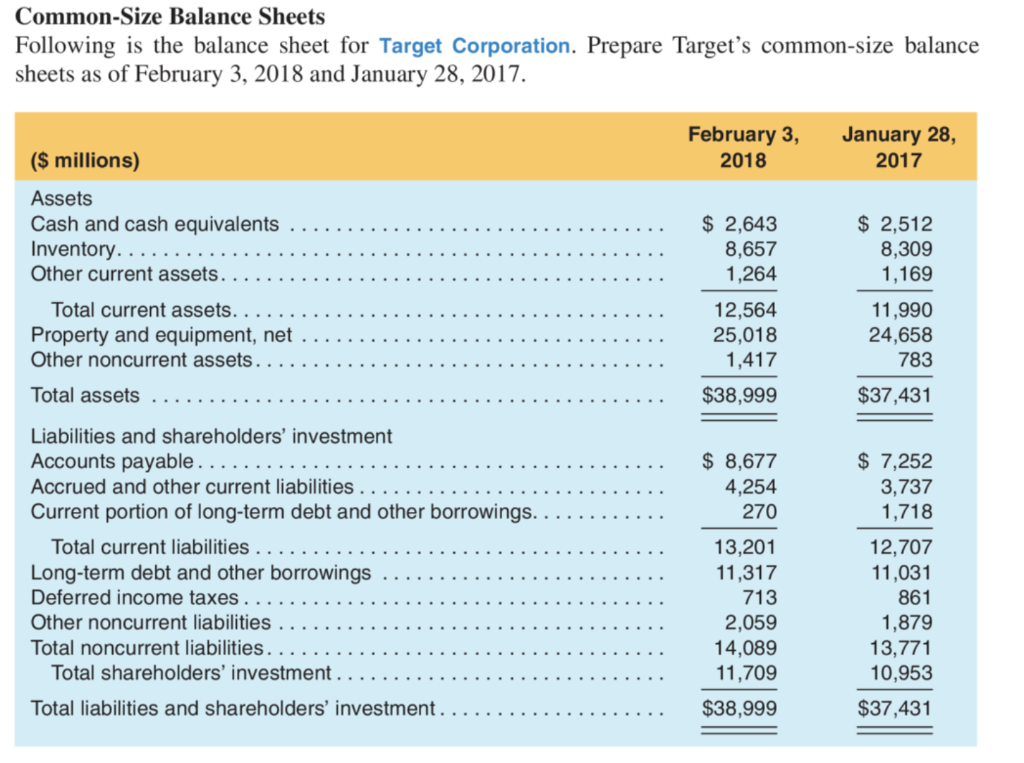

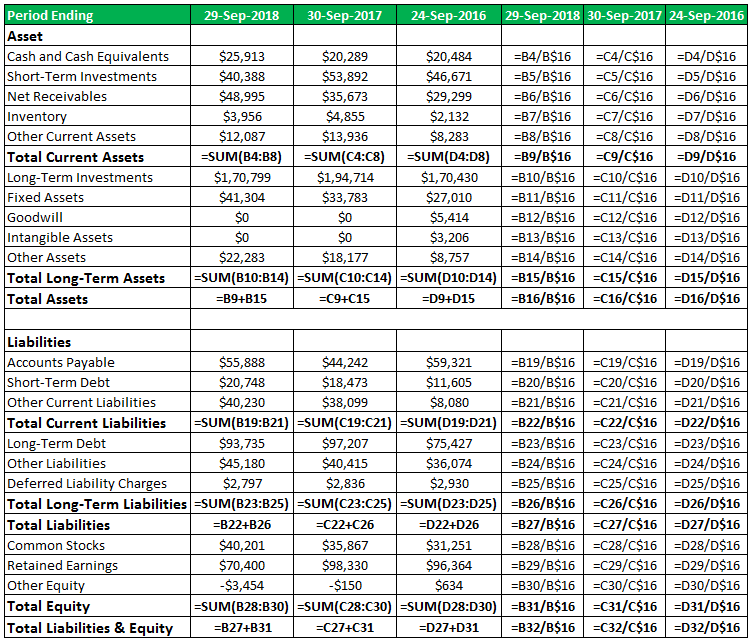

Common Sized Balance Sheet - Assets are expressed as a percentage of total assets, liabilities as a percentage. The balance sheet equation is assets equals liabilities plus stockholders' equity. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web a common size balance sheet is set up with the same logic as the common size income statement. Web key takeaways the common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to.

The balance sheet equation is assets equals liabilities plus stockholders' equity. Assets are expressed as a percentage of total assets, liabilities as a percentage. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web a common size balance sheet is set up with the same logic as the common size income statement. Web common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to. Web key takeaways the common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.

Web a common size balance sheet is set up with the same logic as the common size income statement. The balance sheet equation is assets equals liabilities plus stockholders' equity. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Assets are expressed as a percentage of total assets, liabilities as a percentage. Web key takeaways the common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.

How to Figure the Common Size BalanceSheet Percentages Online Accounting

Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the balance sheet common size analysis mostly uses the total assets value.

Simple Balance Sheet 24+ Free Word, Excel, PDF Documents Download

The balance sheet equation is assets equals liabilities plus stockholders' equity. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. A financial manager or investor.

Common Size Balance Sheet Finance Train

Web common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to. Web key takeaways the common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. Assets are expressed.

Solved CommonSize Balance Sheets Consider the following

The balance sheet equation is assets equals liabilities plus stockholders' equity. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Assets are.

Common Size Balance Sheet Calculator Double Entry Bookkeeping

Web a common size balance sheet is set up with the same logic as the common size income statement. The balance sheet equation is assets equals liabilities plus stockholders' equity. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web the balance.

Common Size Balance Sheet Meaning, Objectives and Format of Common

The balance sheet equation is assets equals liabilities plus stockholders' equity. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the balance sheet common size analysis mostly uses the total assets value as the base value. Web a common size balance sheet is set up with the same.

Common Size Balance Sheet Analysis (Format, Examples)

The balance sheet equation is assets equals liabilities plus stockholders' equity. Web common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to. Web key takeaways the common size balance sheet analyzes a balance sheet that presents each.

Solved CommonSize Balance Sheets Following is the balance

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web the balance sheet common size analysis mostly uses the total assets value.

Common Size Balance Sheet Format

A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web a common size balance sheet is set up with the same logic as the common size income statement. The balance sheet equation is assets equals liabilities plus stockholders' equity. Web key takeaways the common size balance sheet analyzes a.

Common Size Balance Sheet Analysis (Format, Examples)

The balance sheet equation is assets equals liabilities plus stockholders' equity. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web a common size balance sheet is set up with the same logic as the common size income statement. A financial manager.

Web A Common Size Balance Sheet Is A Balance Sheet That Displays Both The Numeric Value And Relative Percentage For Total Assets, Total Liabilities, And Equity Accounts.

Web key takeaways the common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to. Web the balance sheet common size analysis mostly uses the total assets value as the base value. The balance sheet equation is assets equals liabilities plus stockholders' equity.

Web A Common Size Balance Sheet Is Set Up With The Same Logic As The Common Size Income Statement.

Assets are expressed as a percentage of total assets, liabilities as a percentage. Web common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to.