Calendar Year Tax

Calendar Year Tax - Simple and affordable€149 flat feemade by expats for expatssign up for free The tax years you can use are: Returns are filed for each calendar year and reflect the financial statements for the business year ending in that calendar year. In this article, we define a fiscal and calendar year, list the. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. Web an annual accounting period does not include a short tax year. You must pay the full year's tax on all vehicles you have in use during the month of july. However, your tax year doesn't necessarily have to end on december 31. Generally, most individuals are calendar year filers. 21, 2023 — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the internal revenue service.

21, 2023 — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the internal revenue service. The fourth month after your fiscal year ends, day 15. Returns are filed for each calendar year and reflect the financial statements for the business year ending in that calendar year. However, your tax year doesn't necessarily have to end on december 31. Generally, most individuals are calendar year filers. Web the vast majority of small businesses use the calendar year as their tax year. The tax years you can use are: Web the calendar year begins on the first of january and ends on 31st december every year, while the fiscal year can begin on any day of the year but will. An individual can adopt a fiscal year. Married couples file joint returns unless they are legally separated or one spouse requests otherwise.

Web the tax period begins on july 1 and ends the following june 30. Web understanding what each involves can help you determine which to use for accounting or tax purposes. However, your tax year doesn't necessarily have to end on december 31. Married couples file joint returns unless they are legally separated or one spouse requests otherwise. Web an annual accounting period does not include a short tax year. Learn when you should use each. Simple and affordable€149 flat feemade by expats for expatssign up for free You must also pay a. Returns are filed for each calendar year and reflect the financial statements for the business year ending in that calendar year. Web calendar year is the period from january 1st to december 31st.

Tax Calendar 2024 2024 Calendar Printable

Web calendar year filers (most common) file on: Web according to its latest tax filings, operation underground railroad, paid embattled founder and former tim ballard a compensation of $600,000 in 2023, despite. Web the vast majority of small businesses use the calendar year as their tax year. Simple and affordable€149 flat feemade by expats for expatssign up for free An.

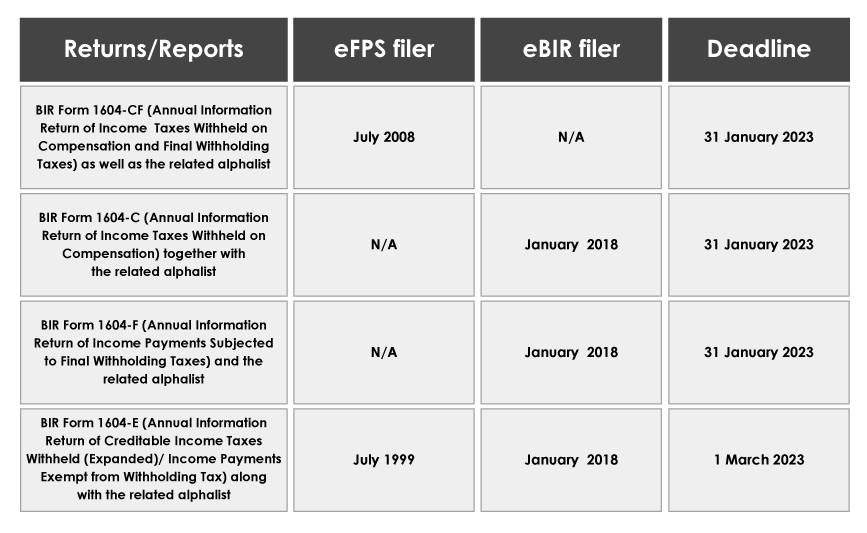

A Guide to the YearEnd Tax Compliance for Corporations

Assessments are issued once the tax office has reviewed the return. Web calendar year is the period from january 1st to december 31st. Web an increase in the controversial minimum unit pricing (mup) will kick into effect on monday, september 30, adding an extra 15 pence to the baseline price of a. Web the fiscal year, a period of 12.

Calendar Year Tax Year? Your 990 Is Due Tony

30, but often is different from the calendar year. An individual can adopt a fiscal year. Learn when you should use each. You must also pay a. Generally, taxpayers filing a version of form 1040 use the calendar year.

Tax Calendar for Calendar Year 2024

In this article, we define a fiscal and calendar year, list the. Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. If day 15 falls on a. You must also pay a. Assessments are issued once the tax office has reviewed the return.

Fillable Online IX. Annual Calendar Year Tax Forms Report Fax Email

The tax years you can use are: Web according to its latest tax filings, operation underground railroad, paid embattled founder and former tim ballard a compensation of $600,000 in 2023, despite. If day 15 falls on a. Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand.

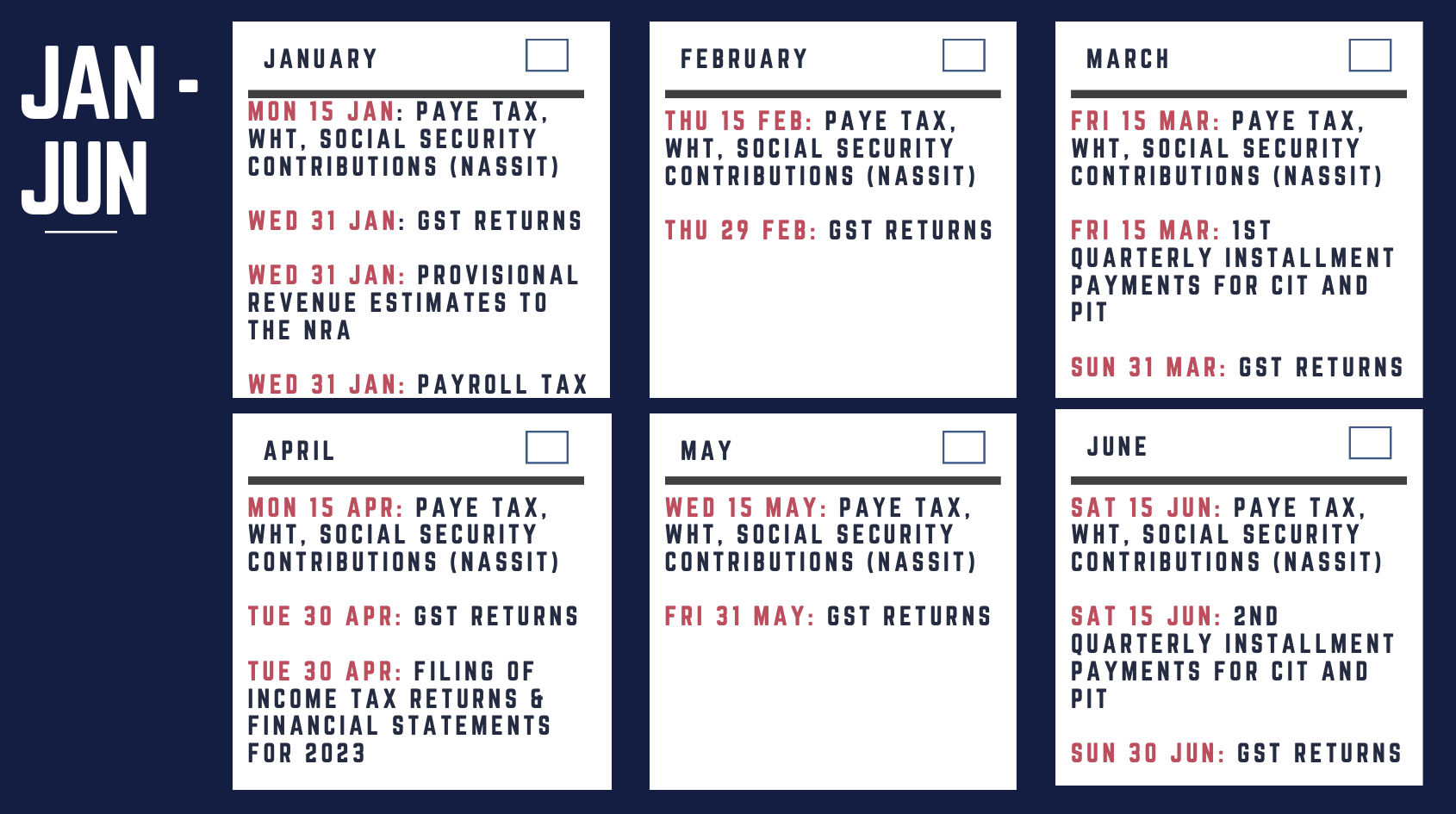

Key Tax Calendar Dates in 2022 Finance Tips Business Accounting Blog

Income tax returns (with the exception of income tax returns on application in. Web understanding what each involves can help you determine which to use for accounting or tax purposes. Returns are, in principle, due by 31 july of the following year. Web the calendar year begins on the first of january and ends on 31st december every year, while.

Your Tax Fact Sheet for the 2020 and 2021 Tax Years Tax Accountant

The tax years you can use are: This also depends on what pay date you use and the pay. You must also pay a. Web the tax year is the calendar year. Assessments are issued once the tax office has reviewed the return.

Tax Calendar

Income tax returns (with the exception of income tax returns on application in. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. You must also pay a. Web an annual accounting period does not include a short tax year. Financial reports, external audits,.

Fiscal Year, Financial Year, Tax Year, Accounting Year & Calendar Year

In this article, we define a fiscal and calendar year, list the. Web the due date for filing your tax return is typically april 15 if you’re a calendar year filer. Simple and affordable€149 flat feemade by expats for expatssign up for free Generally, most individuals are calendar year filers. Web calendar year is the period from january 1st to.

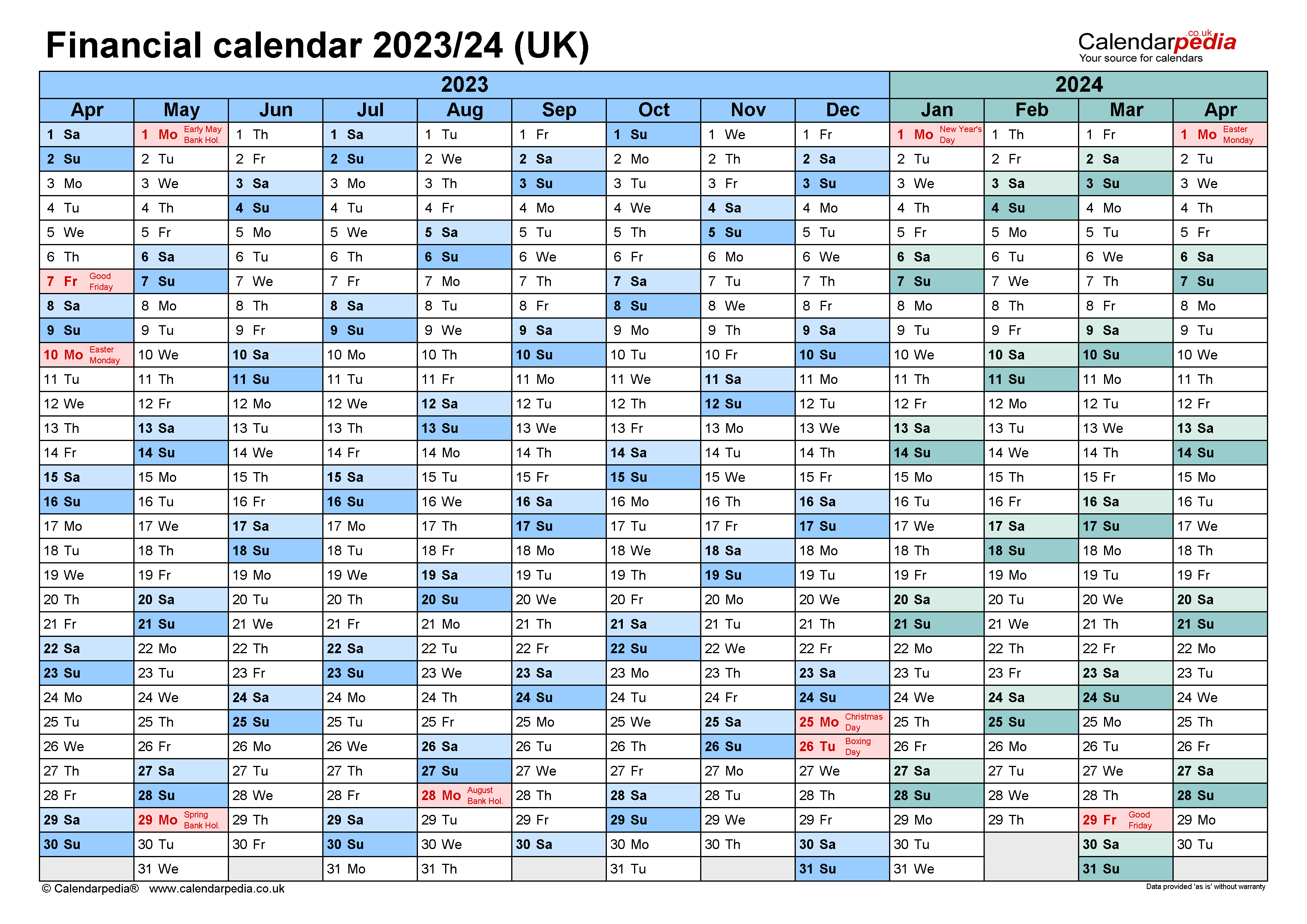

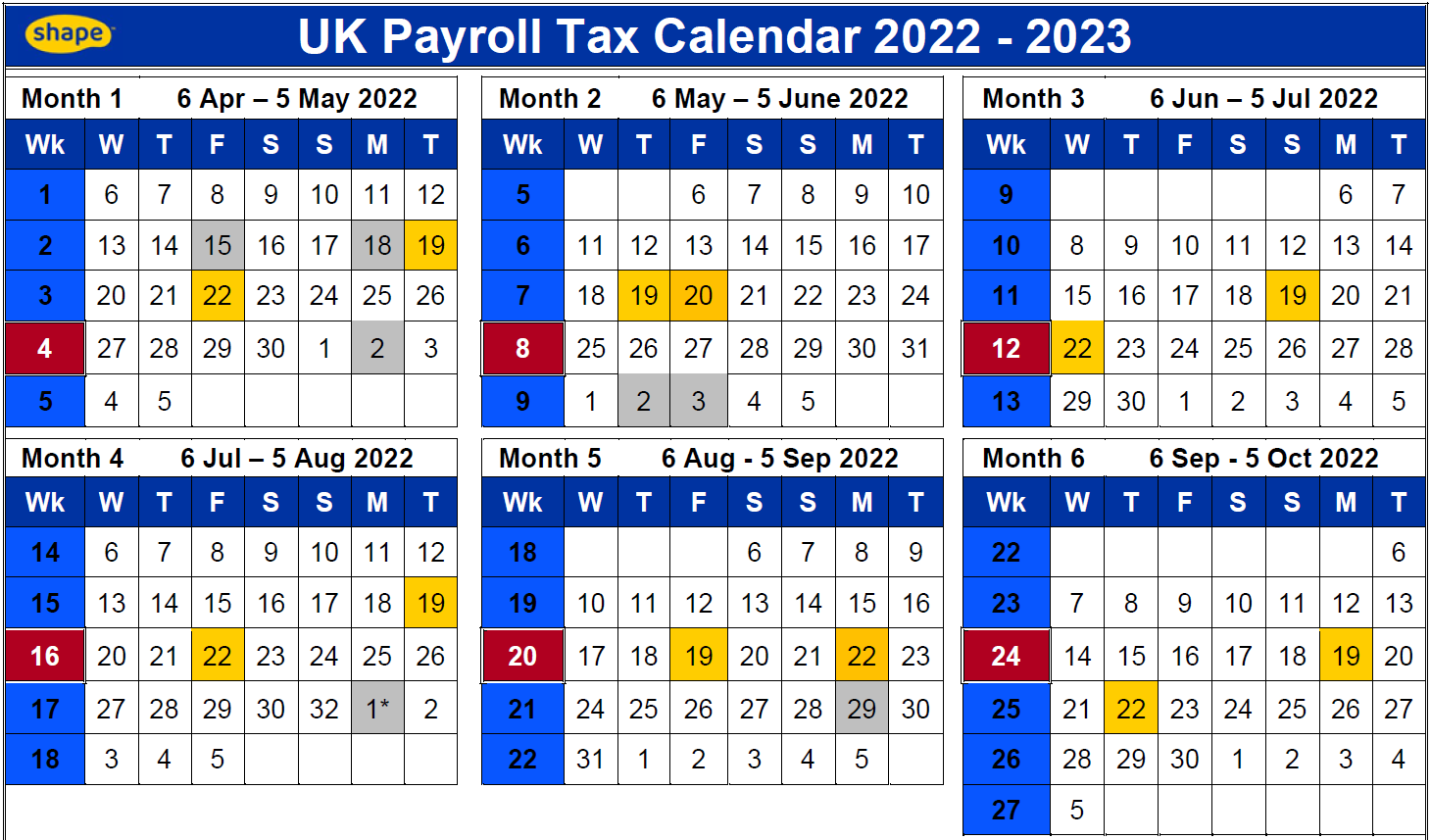

UK Payroll Tax Calendar 20222023 Shape Payroll

Returns are, in principle, due by 31 july of the following year. Web the tax period begins on july 1 and ends the following june 30. Web the real estate assessment review and appeal process begins when notices of assessment are mailed in early february of each calendar year. Web an annual accounting period does not include a short tax.

Web The Fiscal Year, A Period Of 12 Months Ending On The Last Day Of The Month, Does Not Line Up With The Traditional Calendar Year.

Tax periods determine the tax and national insurance thresholds used to calculate your employees' pay. Web an annual accounting period does not include a short tax year. Web the irs distinguishes a fiscal tax year from the calendar year, defined as either 12 consecutive months ending on the last day of any month except december. Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand that part but.

Web A Fiscal Year Can Run From Jan.

Web an increase in the controversial minimum unit pricing (mup) will kick into effect on monday, september 30, adding an extra 15 pence to the baseline price of a. Web calendar year is the period from january 1st to december 31st. You must pay the full year's tax on all vehicles you have in use during the month of july. You must also pay a.

Web The Calendar Year Begins On The First Of January And Ends On 31St December Every Year, While The Fiscal Year Can Begin On Any Day Of The Year But Will.

Web according to its latest tax filings, operation underground railroad, paid embattled founder and former tim ballard a compensation of $600,000 in 2023, despite. If day 15 falls on a. Simple and affordable€149 flat feemade by expats for expatssign up for free Web calendar year filers (most common) file on:

In This Article, We Define A Fiscal And Calendar Year, List The.

Web the vast majority of small businesses use the calendar year as their tax year. Income tax returns (with the exception of income tax returns on application in. 21, 2023 — following feedback from taxpayers, tax professionals and payment processors and to reduce taxpayer confusion, the internal revenue service. The tax years you can use are: