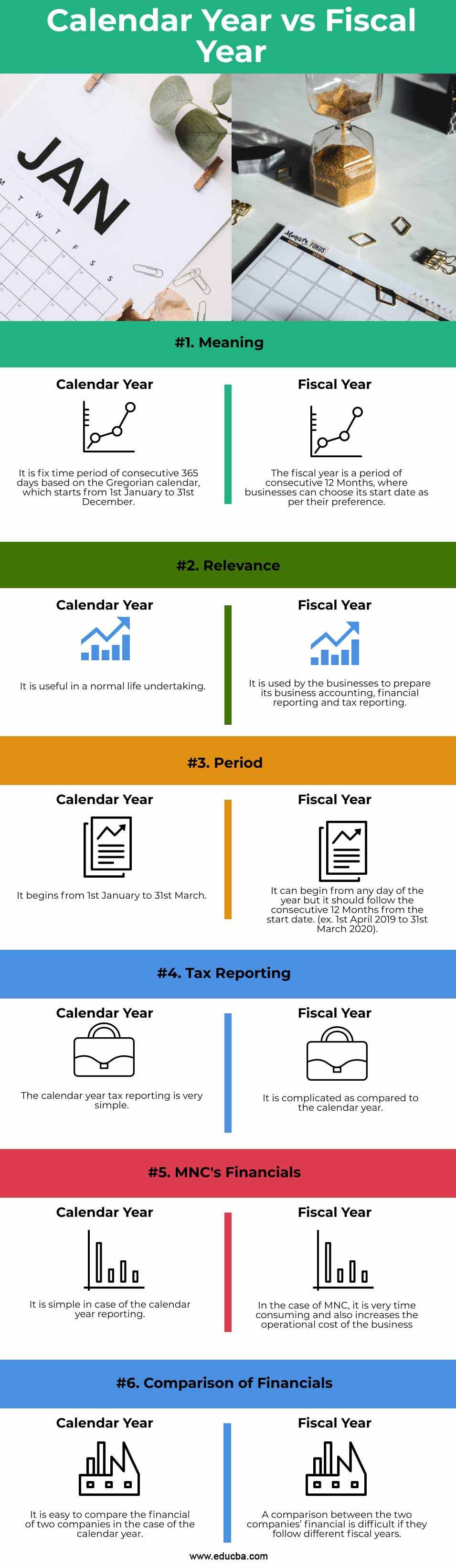

Calendar Year Fiscal Year

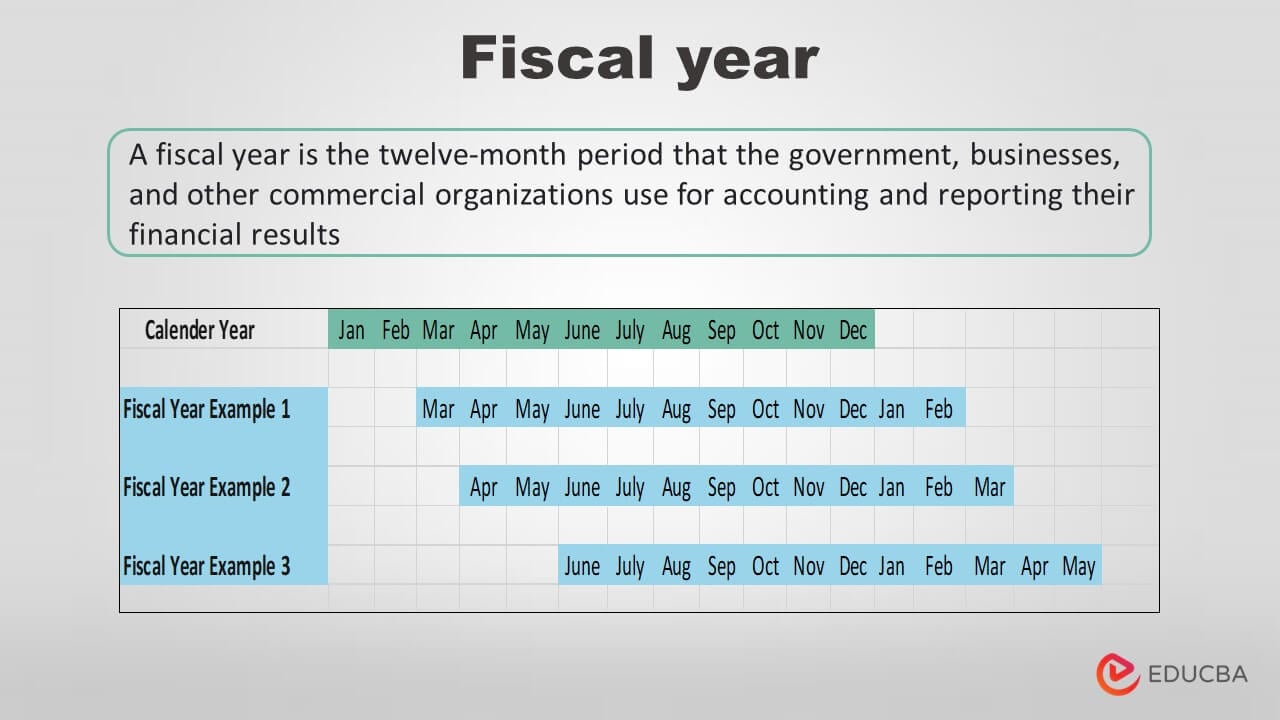

Calendar Year Fiscal Year - If a company has a fiscal year. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. Web definition of fiscal year vs. In some jurisdictions, particularly those that permit tax consolidation, companies that are part of a group of businesses must use nearly the same fiscal year (differences of up to three months are permitted in some jurisdictions, such as the us and japan), with consolidating entries to adjust for transactions between units with different fiscal years, so the same resources will not be counted more than once or not at all. Full year fiscal 2024 net loss. Web january to december represents a calendar year: While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the. A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that. Returns the last day of the fiscal year, which. Web what is a fiscal year?

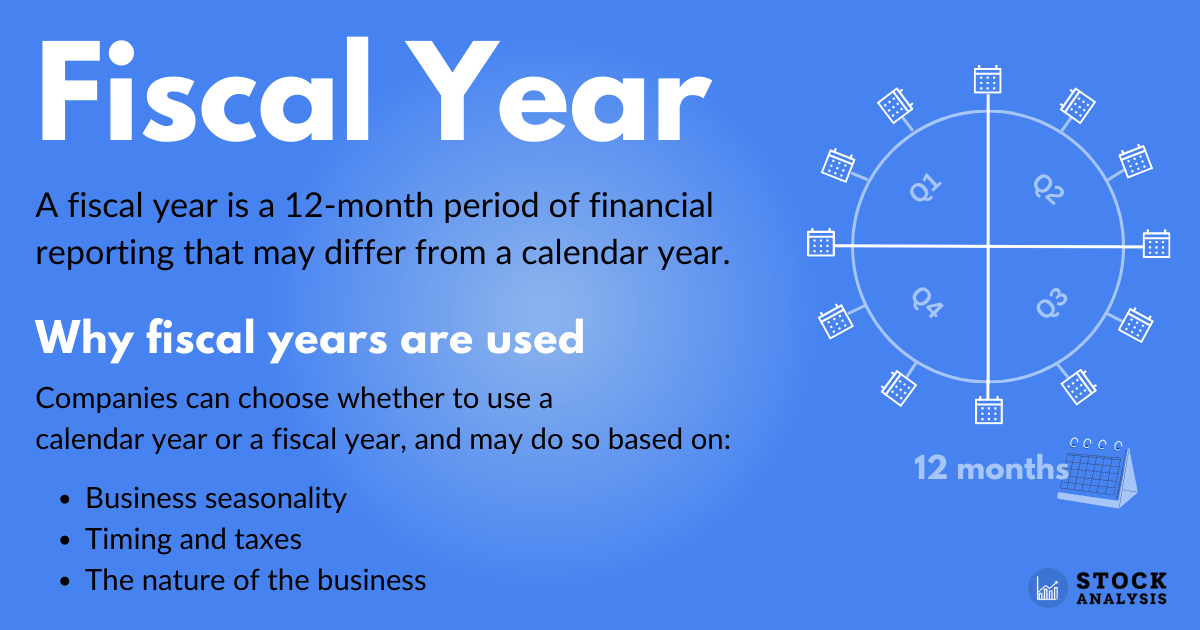

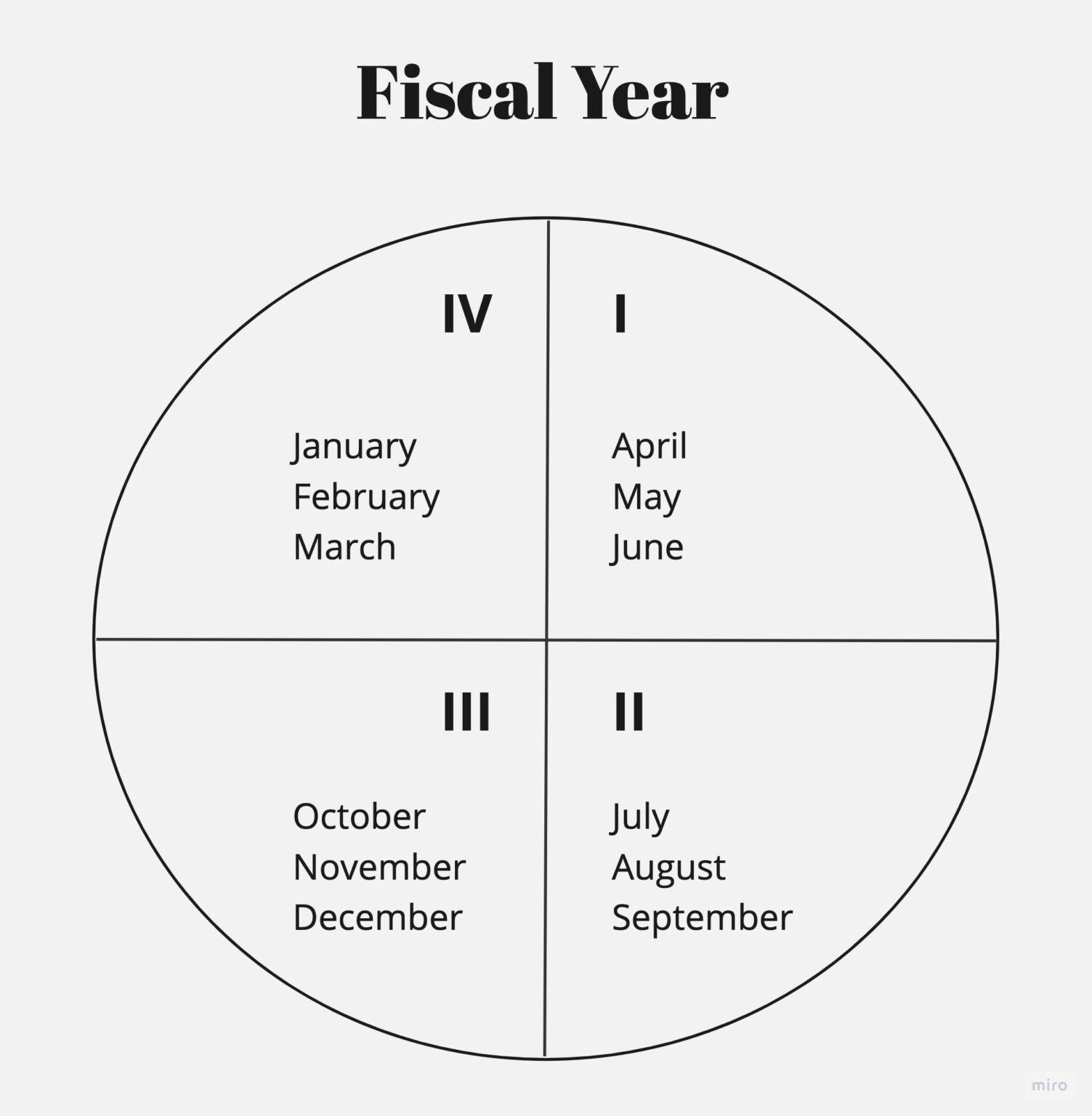

Web today is july 1, the first day of the new financial year in australia. Countries, companies, and organizations can start and. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Learn when you should use each. While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the. A fiscal year, on the other hand, is any. If a company has a fiscal year. Also called fiscal years, financial years are often abbreviated in print. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. Web what is a fiscal year?

Web a fiscal year is a period lasting one year but not necessarily starting at the beginning of the calendar year. Countries, companies, and organizations can start and. It's used differently by the government and businesses, and does need to correspond to a. While both periods last for. Returns the first day of the fiscal year, which is always in the previous calendar year. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. Web what is a fiscal year? Most other countries begin their year at a different calendar. Full year fiscal 2024 net loss.

What is a Fiscal Year? Your GoTo Guide

Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago. While the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the. While both periods last for. It's used differently by the government.

How to Convert a Date into Fiscal Year ExcelNotes

It's used differently by the government and businesses, and does need to correspond to a. Web a fiscal year is a period lasting one year but not necessarily starting at the beginning of the calendar year. A fiscal year, on the other hand, is any. Learn when you should use each. A fiscal year can vary from company.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Web definition of fiscal year vs. Countries, companies, and organizations can start and. What is a fiscal year? Ask a company accountant or a chief financial officer. A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes.

What is the Difference Between Fiscal Year and Calendar Year

A fiscal year is the 12 months that a company designates as a year for financial and tax reporting purposes. Web whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. Returns the first day of the fiscal year, which is always in the previous calendar year. Also.

Fiscal Year vs Calendar Year Difference and Comparison

Returns the last day of the fiscal year, which. Web whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. Web what is a fiscal year? What is a fiscal year? Web definition of fiscal year vs.

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

Returns the last day of the fiscal year, which. Web what is a fiscal year? Web january to december represents a calendar year: Web today is july 1, the first day of the new financial year in australia. What is a fiscal year?

Fiscal Year Calendar Template for 2014 and Beyond

Web january to december represents a calendar year: It's used differently by the government and businesses, and does need to correspond to a. Web what is a fiscal year? Web whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year. Returns the first day of the fiscal year,.

Fiscal Year Definition, Use Cases, and Examples Stock Analysis

While both periods last for. In some jurisdictions, particularly those that permit tax consolidation, companies that are part of a group of businesses must use nearly the same fiscal year (differences of up to three months are permitted in some jurisdictions, such as the us and japan), with consolidating entries to adjust for transactions between units with different fiscal years,.

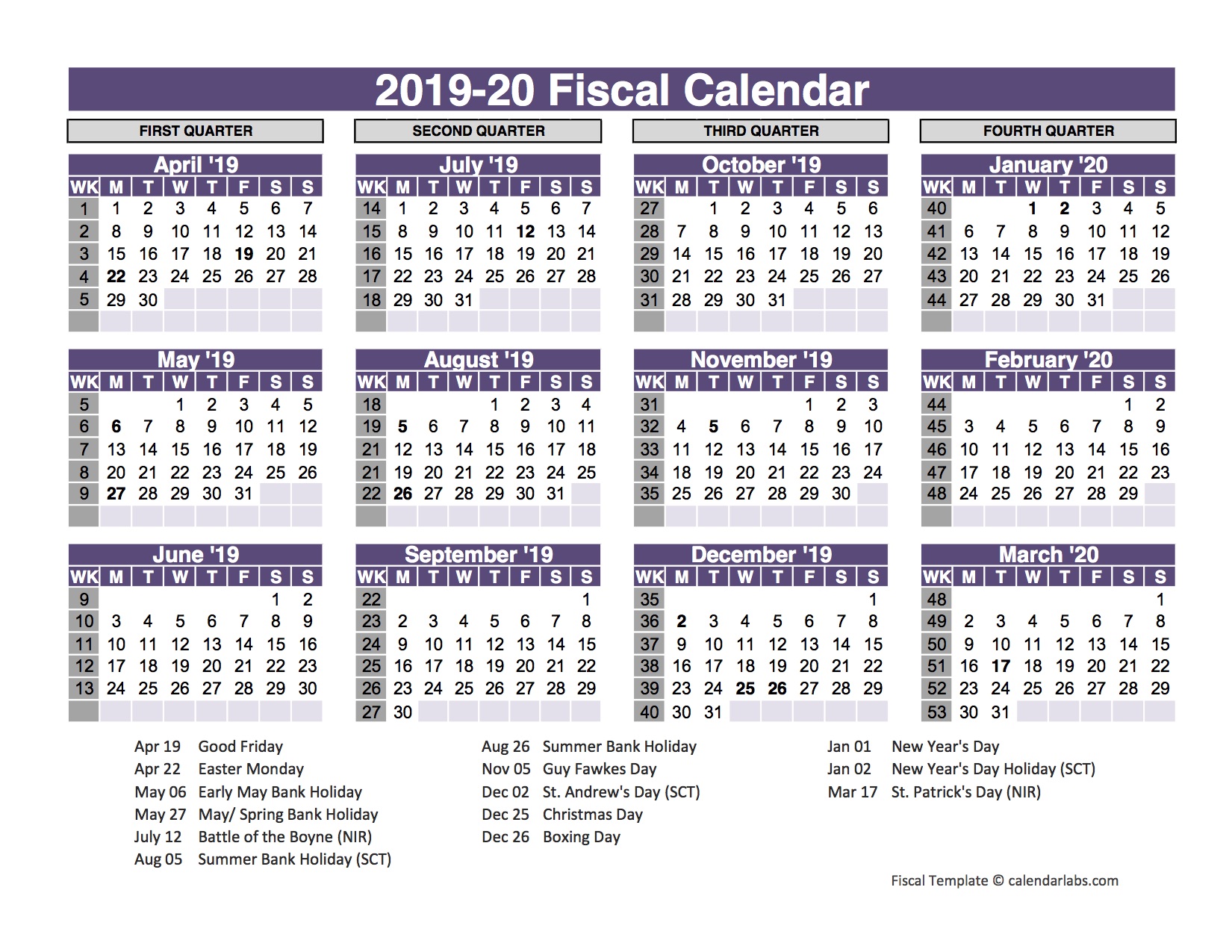

UK Fiscal Calendar Template 201920 Free Printable Templates

Web a fiscal year is a period lasting one year but not necessarily starting at the beginning of the calendar year. It's used differently by the government and businesses, and does need to correspond to a. Ask a company accountant or a chief financial officer. A fiscal year can vary from company. Web net loss was $23.0 million for the.

Fiscal Year Meaning, Difference With Assessment Year, Benefits, And

Returns the last day of the fiscal year, which. A fiscal year, on the other hand, is any. Most other countries begin their year at a different calendar. Web using a different fiscal year than the calendar year lets seasonal businesses choose the start and end dates that better align with their revenue and. What is a fiscal year?

While The Fiscal Year Is A 12 Month Period Whereby Businesses Choose The Preferred Start And End Of The Period, The.

Returns the last day of the fiscal year, which. What is a fiscal year? Web a fiscal year is a period lasting one year but not necessarily starting at the beginning of the calendar year. Returns the first day of the fiscal year, which is always in the previous calendar year.

Countries, Companies, And Organizations Can Start And.

A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year that. In some jurisdictions, particularly those that permit tax consolidation, companies that are part of a group of businesses must use nearly the same fiscal year (differences of up to three months are permitted in some jurisdictions, such as the us and japan), with consolidating entries to adjust for transactions between units with different fiscal years, so the same resources will not be counted more than once or not at all. Web we’ll explore how to think about picking a fiscal year, how adopting a fiscal year can impact your business, and whether you might be better off sticking with the calendar. Web net loss was $23.0 million for the fourth quarter of fiscal 2024 compared with a net loss of $12.7 million for the same period a year ago.

This Year Can Differ From.

A fiscal year can vary from company. Ask a company accountant or a chief financial officer. A fiscal year, on the other hand, is any. Web whether you’re preparing financial statements or filing taxes, it’s important to understand the difference between a fiscal year and a calendar year.

Web What Is A Fiscal Year?

Web january to december represents a calendar year: Full year fiscal 2024 net loss. Web definition of fiscal year vs. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year.