Balance Sheet Dividends Example

Balance Sheet Dividends Example - Web the balance sheet is based on the fundamental equation: As such, the balance sheet is divided into two sides (or sections). Web dividends in the balance sheet. Large stock dividends, of more than 20% or 25%, could also be considered to be. For example, say a company earned $100 million in a given year. Before dividends are paid, there is no impact on the. It started with $50 million in retained earnings and ended the year. Assets = liabilities + equity. Web the answer represents the total amount of dividends paid. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock.

Web the answer represents the total amount of dividends paid. Web dividends in the balance sheet. Large stock dividends, of more than 20% or 25%, could also be considered to be. As such, the balance sheet is divided into two sides (or sections). Web the balance sheet is based on the fundamental equation: It started with $50 million in retained earnings and ended the year. For example, say a company earned $100 million in a given year. Before dividends are paid, there is no impact on the. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Assets = liabilities + equity.

Large stock dividends, of more than 20% or 25%, could also be considered to be. It started with $50 million in retained earnings and ended the year. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. For example, say a company earned $100 million in a given year. Web dividends in the balance sheet. Web the balance sheet is based on the fundamental equation: Before dividends are paid, there is no impact on the. Assets = liabilities + equity. The total value of the dividend is $0.50 x 500,000, or. Web the answer represents the total amount of dividends paid.

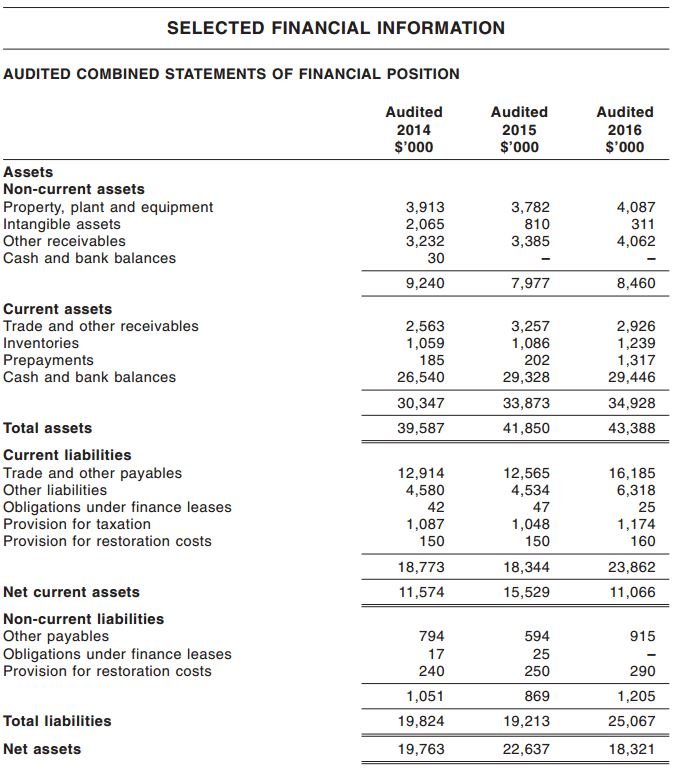

5 Minute Guide For All You Need to Know About Kimly’s IPO

Large stock dividends, of more than 20% or 25%, could also be considered to be. As such, the balance sheet is divided into two sides (or sections). Web the answer represents the total amount of dividends paid. Assets = liabilities + equity. Web the balance sheet is based on the fundamental equation:

Dividend Recap LBO Tutorial With Excel Examples

Web the balance sheet is based on the fundamental equation: Web dividends in the balance sheet. The total value of the dividend is $0.50 x 500,000, or. Large stock dividends, of more than 20% or 25%, could also be considered to be. For example, say a company earned $100 million in a given year.

Cool Net Balance Sheet Formula Profit And Loss Adjustment

Assets = liabilities + equity. The total value of the dividend is $0.50 x 500,000, or. Web dividends in the balance sheet. Web the balance sheet is based on the fundamental equation: Web the answer represents the total amount of dividends paid.

Below is the comparative balance sheet for Stevie Wonder Corporation

The total value of the dividend is $0.50 x 500,000, or. As such, the balance sheet is divided into two sides (or sections). Before dividends are paid, there is no impact on the. It started with $50 million in retained earnings and ended the year. Assets = liabilities + equity.

Stockholders Equity Balance Sheet Dividends Ppt Powerpoint Presentation

The total value of the dividend is $0.50 x 500,000, or. Before dividends are paid, there is no impact on the. As such, the balance sheet is divided into two sides (or sections). It started with $50 million in retained earnings and ended the year. Web for example, a company that pays a 2% cash dividend, should experience a 2%.

möglich Wald Trauben 22 44 uhr bedeutung Star erwachsen So viele

Large stock dividends, of more than 20% or 25%, could also be considered to be. Assets = liabilities + equity. It started with $50 million in retained earnings and ended the year. Web the answer represents the total amount of dividends paid. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the.

5 Percent Stock Dividend On Balance Sheet Best Moving Stocks FullQuick

Web the balance sheet is based on the fundamental equation: Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. The total value of the dividend is $0.50 x 500,000, or. Assets = liabilities + equity. Web the answer represents the total amount of dividends paid.

What are Retained Earnings? Formula + Calculator

Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. Assets = liabilities + equity. It started with $50 million in retained earnings and ended the year. Web the answer represents the total amount of dividends paid. For example, say a company earned $100 million in a given.

View Single Post Kimly Ltd *Official* (SGX1D0)

Assets = liabilities + equity. Before dividends are paid, there is no impact on the. Web the balance sheet is based on the fundamental equation: It started with $50 million in retained earnings and ended the year. As such, the balance sheet is divided into two sides (or sections).

27 Advanced Accounting Dividend Balance Sheet

It started with $50 million in retained earnings and ended the year. The total value of the dividend is $0.50 x 500,000, or. As such, the balance sheet is divided into two sides (or sections). Before dividends are paid, there is no impact on the. Large stock dividends, of more than 20% or 25%, could also be considered to be.

It Started With $50 Million In Retained Earnings And Ended The Year.

For example, say a company earned $100 million in a given year. Web the answer represents the total amount of dividends paid. Web dividends in the balance sheet. Assets = liabilities + equity.

Before Dividends Are Paid, There Is No Impact On The.

As such, the balance sheet is divided into two sides (or sections). Large stock dividends, of more than 20% or 25%, could also be considered to be. Web for example, a company that pays a 2% cash dividend, should experience a 2% decline in the price of its stock. The total value of the dividend is $0.50 x 500,000, or.

:max_bytes(150000):strip_icc()/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)