Amortization On Balance Sheet

Amortization On Balance Sheet - It's similar to depreciation, but that term is meant more for tangible assets. This cost is considered an expense in accounting and is subtracted from the income. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. Amortization expenses can affect a company’s income statement and balance. Web the term “amortization” refers to two situations. This shifts the asset to the. Web amortization refers to capitalizing the value of an intangible asset over time. Web in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. First, amortization is used in the process of paying off debt through regular principal and interest payments over time.

Amortization expenses can affect a company’s income statement and balance. This cost is considered an expense in accounting and is subtracted from the income. It's similar to depreciation, but that term is meant more for tangible assets. This shifts the asset to the. Web amortization refers to capitalizing the value of an intangible asset over time. First, amortization is used in the process of paying off debt through regular principal and interest payments over time. Web the term “amortization” refers to two situations. Web in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful.

This cost is considered an expense in accounting and is subtracted from the income. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. This shifts the asset to the. First, amortization is used in the process of paying off debt through regular principal and interest payments over time. Web the term “amortization” refers to two situations. Web in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. Web amortization refers to capitalizing the value of an intangible asset over time. Amortization expenses can affect a company’s income statement and balance. It's similar to depreciation, but that term is meant more for tangible assets.

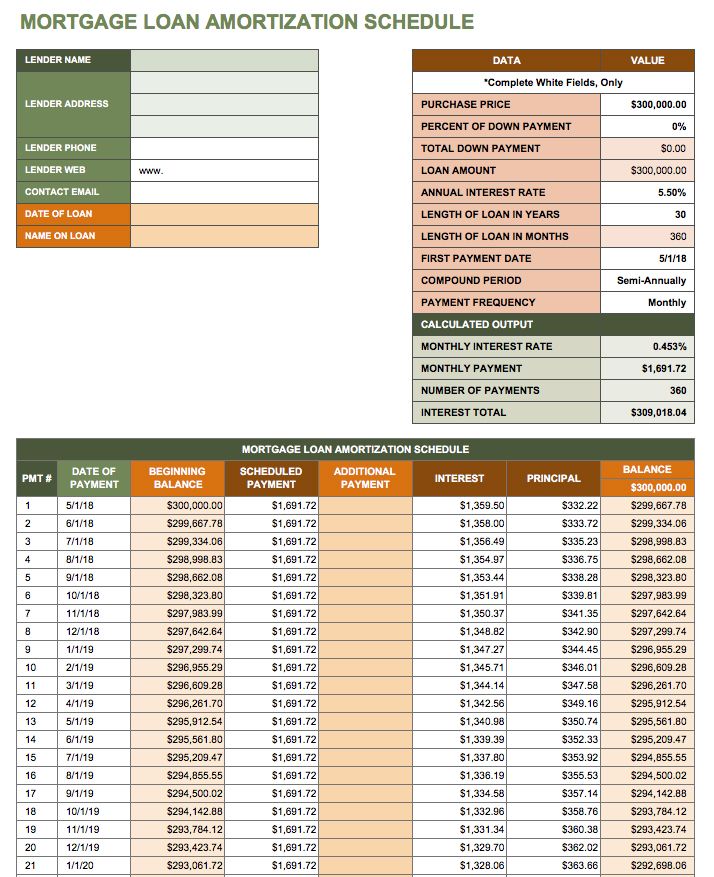

Amortization Schedules and Balance Sheet YouTube

This cost is considered an expense in accounting and is subtracted from the income. Web the term “amortization” refers to two situations. It's similar to depreciation, but that term is meant more for tangible assets. This shifts the asset to the. Amortization expenses can affect a company’s income statement and balance.

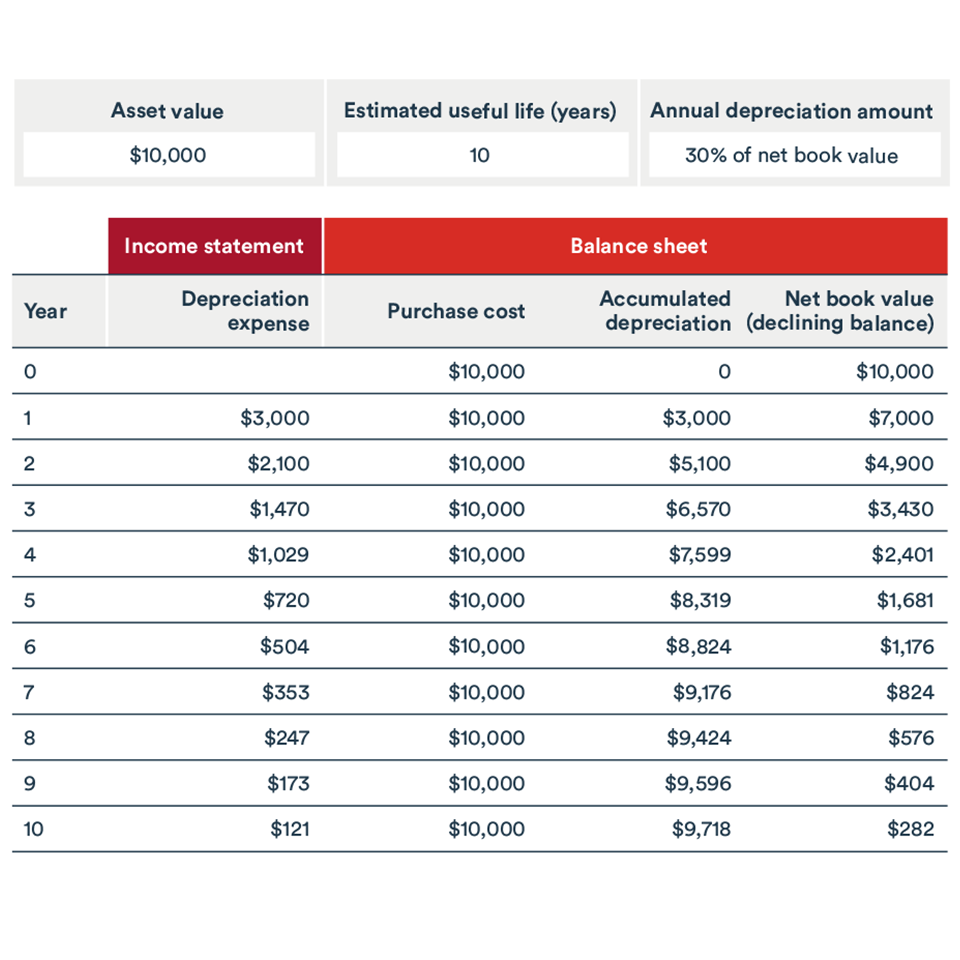

Amortization vs. Depreciation What's the Difference? (2022)

First, amortization is used in the process of paying off debt through regular principal and interest payments over time. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. Web in business, amortization is the practice of writing down the value of an intangible asset, such as a.

Basic Amortization Schedule Excel Excel Templates

Web the term “amortization” refers to two situations. This cost is considered an expense in accounting and is subtracted from the income. Amortization expenses can affect a company’s income statement and balance. It's similar to depreciation, but that term is meant more for tangible assets. Web amortization refers to capitalizing the value of an intangible asset over time.

How to Calculate Amortization on Patents 10 Steps (with Pictures)

Amortization expenses can affect a company’s income statement and balance. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. It's similar to depreciation, but that term is meant more for tangible assets. This shifts the asset to the. Web amortization refers to capitalizing the value of an.

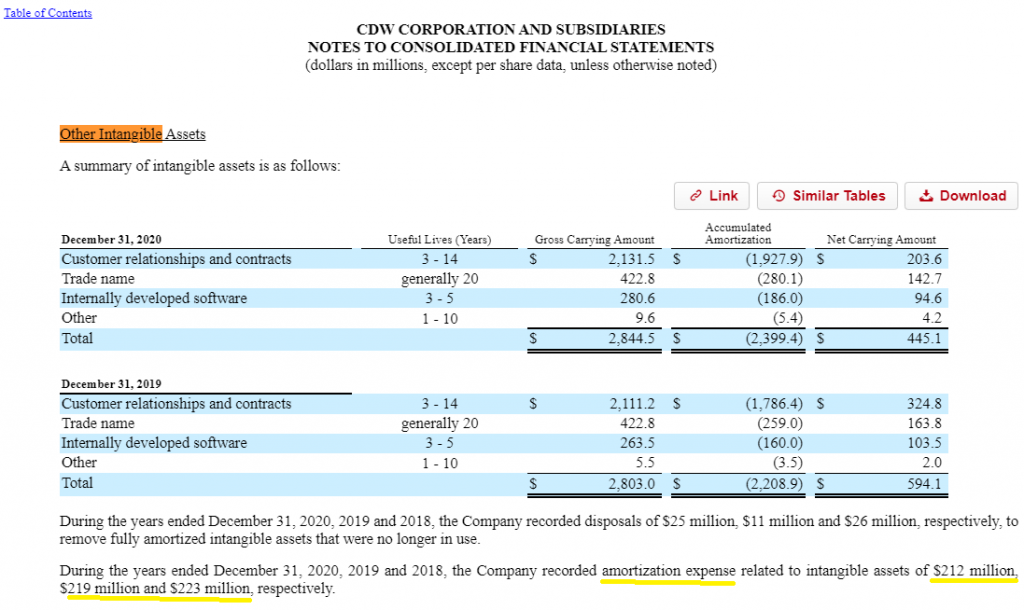

Goodwill, Patents, and Other Intangible Assets Financial Accounting

Web the term “amortization” refers to two situations. Amortization expenses can affect a company’s income statement and balance. This shifts the asset to the. It's similar to depreciation, but that term is meant more for tangible assets. First, amortization is used in the process of paying off debt through regular principal and interest payments over time.

Free Excel Amortization Schedule Templates Smartsheet

This shifts the asset to the. Web the term “amortization” refers to two situations. It's similar to depreciation, but that term is meant more for tangible assets. This cost is considered an expense in accounting and is subtracted from the income. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time.

Prepaid Amortization Schedule Excel Template

It's similar to depreciation, but that term is meant more for tangible assets. First, amortization is used in the process of paying off debt through regular principal and interest payments over time. Web the term “amortization” refers to two situations. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it.

Daily Amortization Schedule Excel Free Resume Templates

Web the term “amortization” refers to two situations. This shifts the asset to the. Web in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. This cost is considered an expense in accounting and is subtracted from the income. It's similar to depreciation, but that.

What is amortization BDC.ca

Web amortization refers to capitalizing the value of an intangible asset over time. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. Web the term “amortization” refers to two situations. It's similar to depreciation, but that term is meant more for tangible assets. This cost is considered.

How Amortization of Intangible Assets Works; When it Unleashes Higher ROIC

Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. Web amortization refers to capitalizing the value of an intangible asset over time. Web the term “amortization” refers to two situations. Amortization expenses can affect a company’s income statement and balance. First, amortization is used in the process.

Amortization Expenses Can Affect A Company’s Income Statement And Balance.

Web in business, amortization is the practice of writing down the value of an intangible asset, such as a copyright or patent, over its useful life. Web amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. Web the term “amortization” refers to two situations. It's similar to depreciation, but that term is meant more for tangible assets.

This Cost Is Considered An Expense In Accounting And Is Subtracted From The Income.

Web amortization refers to capitalizing the value of an intangible asset over time. First, amortization is used in the process of paying off debt through regular principal and interest payments over time. This shifts the asset to the.

:max_bytes(150000):strip_icc()/Amazon3-88916bd66a244178b1f977a1d758dda0.JPG)